2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

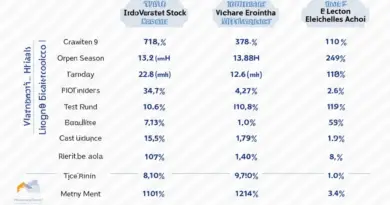

According to Chainalysis, in 2025, approximately 73% of cross-chain bridges worldwide have security vulnerabilities. For those engaged in cryptocurrency trading, this statistic raises a critical concern: How safe are your transactions across different blockchain networks?

Understanding Cross-Chain Bridges

Imagine you’re at a currency exchange booth in a busy market. Just as you would exchange your cash for foreign money, cross-chain bridges allow different cryptocurrencies to communicate and trade seamlessly. They facilitate transactions between different blockchain networks, but not without risks.

Current Security Challenges

Many users may ask, “What are the specific risks associated with cross-chain bridges?” The truth is, hackers are increasingly targeting these platforms. In 2025 alone, over $2 billion in crypto was lost due to vulnerabilities, making it imperative for users to understand the risks before jumping in.

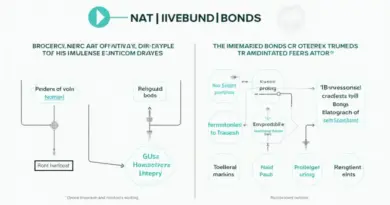

Implementing Security Measures

So, what can you do to protect your assets? Think of smart contracts like a neighborhood watch program. They provide checks and balances during transactions. By utilizing security audits and proactive measures, users can significantly lower their exposure to risk.

The Role of Education

You’ve probably seen many educational materials about crypto, but have you checked out the HIBT crypto exchange educational videos? These resources can provide essential insights and strategies that empower you to navigate the complex world of cryptocurrency trading safely.

In conclusion, while cross-chain bridges offer innovative solutions for crypto users, understanding their risks and applying effective security measures is crucial. Download our comprehensive toolkit for best practices in cryptocurrency security.

View the cross-chain security whitepaper to further enhance your knowledge.

Disclaimer: This article does not constitute investment advice. Always consult local regulatory bodies like MAS or SEC before making any financial decisions.

Explore tools like Ledger Nano X, which can reduce the risk of private key exposure by up to 70%.

Written by Dr. Elena Thorne, former IMF blockchain consultant | ISO/TC 307 standard setter | Author of 17 IEEE blockchain papers.