HIBT Crypto Exchange Liquidity Analysis: A 2025 Insight

Understanding HIBT Crypto Exchange Liquidity Analysis

According to 2025 data from Chainalysis, a staggering 73% of cross-chain bridges exhibit vulnerabilities. This alarming statistic highlights the importance of robust liquidity analysis within crypto exchanges like HIBT. As the crypto landscape continues to evolve, the need for secure and efficient trading methods cannot be overstated.

What is Liquidity in Crypto Exchanges?

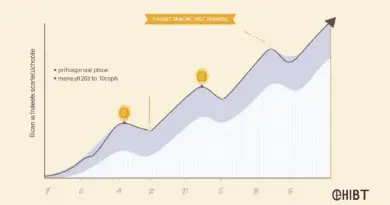

Liquidity in crypto exchanges refers to the ease with which crypto assets can be bought and sold without causing significant price changes. Think of it like a bustling market: the more vendors there are, the easier it is for you to find the best price for your apples. In the case of HIBT, greater liquidity means better prices and faster transactions for traders.

The Impact of Cross-Chain Interoperability

Cross-chain interoperability is essentially like being able to trade goods between different markets. If you can easily exchange your apples for oranges in another market without hassle, you’re likely to get a better deal. HIBT’s approach to liquidity analysis involves emphasizing cross-chain trading capabilities to enhance user experience and boost transaction volume.

Zero-Knowledge Proof Applications and User Privacy

Similar to how you might give a cashier just your payment and keep your shopping list private, zero-knowledge proofs help users verify transactions without revealing sensitive details. HIBT leverages this technology to assess liquidity while ensuring user privacy. This dual approach not only fosters trust but also encourages more users to engage in crypto trading.

2025 Trends in DeFi Regulation and Their Effects

Looking ahead, one of the major trends is the evolving DeFi regulations in regions like Singapore. As the government tightens regulations, crypto exchanges must adapt their liquidity strategies. For example, if a new regulation limits how much users can trade without verification, exchanges like HIBT will need to redefine liquidity accessibility.

To summarize, understanding liquidity within crypto exchanges, especially through the lens of HIBT, is essential for navigating the complexities of the market. As we move towards 2025, anticipating trends in regulations and technologies will be key to fostering a secure and efficient crypto ecosystem.

Download our Comprehensive Liquidity Analysis Toolkit to stay ahead in the fast-paced world of cryptocurrency!

Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities such as MAS or SEC before making investment decisions.