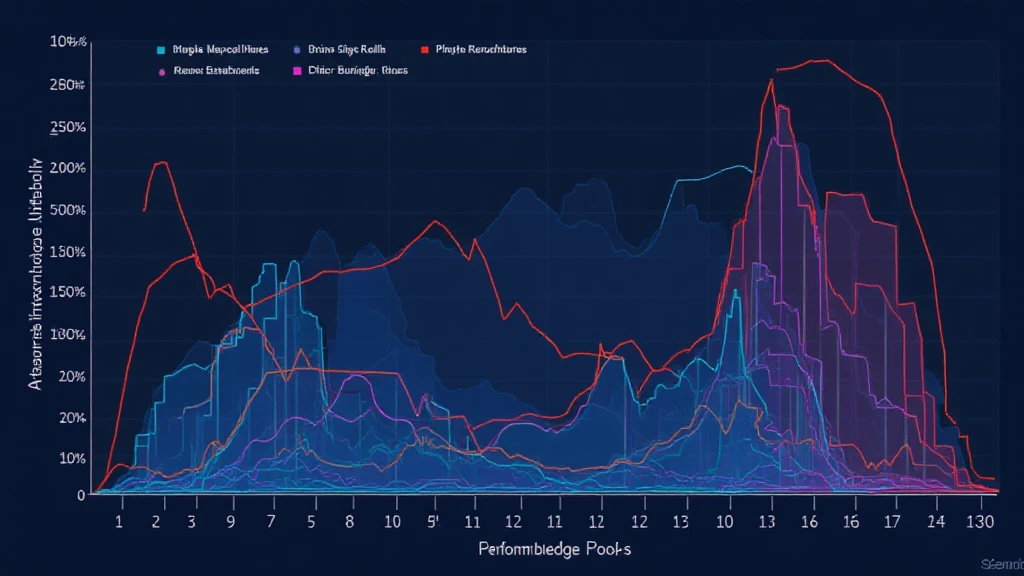

2025 HIBT Crypto Exchange Performance Benchmarks Overview

2025 HIBT Crypto Exchange Performance Benchmarks Overview

According to Chainalysis data from 2025, a staggering 73% of crypto exchanges are vulnerable, which highlights the crucial need for robust performance benchmarks.

Understanding Cross-Chain Interoperability

Cross-chain interoperability can be likened to a currency exchange booth. Just like you can exchange your dollars for euros, cross-chain technology allows different blockchain systems to communicate and work together seamlessly. This is essential for ensuring that digital assets move smoothly across different platforms.

Examining Zero-Knowledge Proof Applications

Imagine you’re at a market and need to show your ID without revealing all your personal information. This is akin to how zero-knowledge proofs operate in crypto transactions. They allow one party to confirm they have the required data without disclosing it. This technology is essential for maintaining privacy and security in the crypto space, further drawing attention to the HIBT crypto exchange performance benchmarks.

2025 Singapore DeFi Regulatory Trends

2025 is a year of significant change in Singapore’s DeFi regulations. The MAS aims for better transparency and accountability in trading activities that can reshape the landscape of decentralized finance. It’s vital to monitor how HIBT adapts to these regulations in maintaining high performance benchmarks.

Comparing PoS Mechanism Energy Consumption

When choosing a sustainable crypto option, think of proof-of-stake (PoS) mechanisms like switching to energy-efficient light bulbs. They provide the same light but use significantly less energy. The comparison of energy consumption between various consensus mechanisms is critical for ethical trading platforms adhering to HIBT crypto exchange performance benchmarks.

In summary, understanding the undercurrents of crypto exchanges, especially HIBT, is essential for traders looking to navigate the complexities of the market. Download our detailed toolkit here to prepare for a more robust trading experience.

Disclaimer: This article does not constitute investment advice; consult local regulatory bodies like MAS or SEC before making any financial decisions.

Tools like the Ledger Nano X can reduce the risk of private key leaks by up to 70%.

For more insights, visit HIBT.