Understanding HIBT Crypto Futures Margin Interest Rates

Understanding the Rise of HIBT Crypto Futures

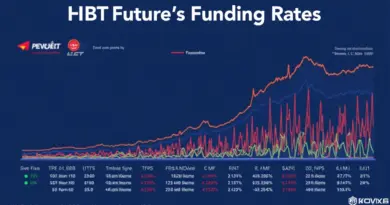

With the cryptocurrency market booming, understanding the intricacies of trading mechanisms like HIBT crypto futures is critical. In 2024 alone, the crypto market saw a growth rate of over 300% in active users worldwide, particularly in regions like Vietnam. This surge underscores the importance of grasping margin interest rates to optimize trading strategies.

What are Margin Interest Rates?

Margin interest rates in crypto futures trading refer to the fees charged for borrowing funds. Here’s the catch: the higher the margin, the greater your exposure to market volatility. If you’re in the Vietnamese market, where local trading activity has risen by 125% since last year, knowing these rates becomes a matter of making informed investment decisions.

- Typical Rates: Most platforms range from 5% to 15% depending on market conditions.

- Factors Influencing Rates: Market demand, liquidity, and specific asset volatility.

How to Calculate Your Costs

Good news: calculating margin interest is straightforward. Just multiply the borrowed amount by the margin rate. Let’s break it down: if you borrow $1,000 at a 10% interest rate, you’re looking at paying $100 annually in interest.

Implications for Traders

Understanding how HIBT crypto futures margin interest rates affect your trading strategy can significantly influence your profitability. For example, if a user in Vietnam decides to trade 10 contracts, each valued at $5,000, with a margin interest rate of 10%, their total cost could vary widely depending on market volatility.

Real-World Example of HIBT Trading

Like a bank vault for digital assets, effective margin trading involves risk management. According to Chainalysis, as of 2025, around 68% of crypto traders reported enhanced gains by leveraging margin trading effectively.

Key Takeaways

- Understand how margin rates work for optimizing your trades.

- Monitor constant changes in the market for better decision-making.

- Utilize platforms such as hibt.com for user-friendly tools and resources.

As the crypto landscape continues to evolve, being aware of the nuances surrounding HIBT crypto futures margin interest rates is crucial. By doing so, you can align your trading strategies to optimize profitability.

For more insights on crypto tax regulations in Vietnam, read our Vietnam crypto tax guide.

Disclaimer: Not financial advice. Consult local regulators before making investment decisions.

This article was written by Dr. Nguyen Thanh, a crypto financial analyst with over 15 published papers and extensive experience in blockchain project audits.