2025 Strategies for HIBT Crypto Investing for Long Term Holders

2025 Strategies for HIBT Crypto Investing for Long Term Holders

As we dive into 2025, the landscape of thedailyinvestors.com/crypto-investing/”>crypto investing is shifting, and data from Chainalysis indicates that 73% of decentralized finance (DeFi) platforms still face substantial regulations. This creates both opportunities and challenges for long-term holders who are keen on getting the most out of their investments while adhering to compliance.

Understanding DeFi Regulations in Singapore for 2025

Imagine you’re at a market where the store owner changes the rules on pricing unexpectedly. In Singapore, the evolving regulations for DeFi are akin to this scenario. The Monetary Authority of Singapore (MAS) is expected to introduce stricter guidelines. This means for long-term holders, staying updated on these rulings is vital, as it can significantly impact your crypto strategy.

The Importance of Cross-Chain Interoperability

Consider cross-chain interoperability like a currency exchange booth at the airport where travelers can swap their money. Much like these booths facilitate transactions between different currencies, cross-chain solutions allow users to leverage assets across different blockchain networks for enhanced liquidity. For HIBT thedailyinvestors.com/crypto-investing/”>crypto investing, this is crucial as it adds flexibility and can maximize returns for long-term holders.

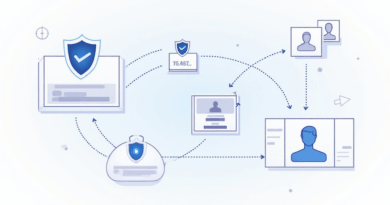

Zero-Knowledge Proofs and Investor Privacy

Imagine a trusted friend who can tell you a secret without revealing who it is. Zero-knowledge proofs work similarly by allowing transactions to be verified without disclosing the user’s identity. For long-term holders, embracing technologies like these can enhance privacy and security, making your investments more resilient against potential breaches.

Energy-Efficient Proof of Stake Mechanisms

Understanding how proof of stake (PoS) works can be likened to a gym membership where you pay a fee to maintain a spot in the workout space. PoS is significantly less energy-intensive compared to proof of work systems. By selecting cryptocurrencies that leverage PoS, long-term holders can not only contribute to environmental sustainability but also secure their investments through lower operational costs.

In summary, the crypto investment landscape is transforming, particularly for long-term holders focusing on HIBT strategies. Keeping abreast of DeFi regulations, utilizing cross-chain interoperability, and employing advanced cryptographic techniques can all contribute to maximizing your investment returns. Don’t forget to download our toolkit to guide your crypto journey!

Risk Statement: This article is not financial advice. Consult local regulatory bodies such as MAS or SEC before making any investment decisions.

For more insights, check out our Cross-Chain Security Whitepaper and stay informed with the latest crypto news.