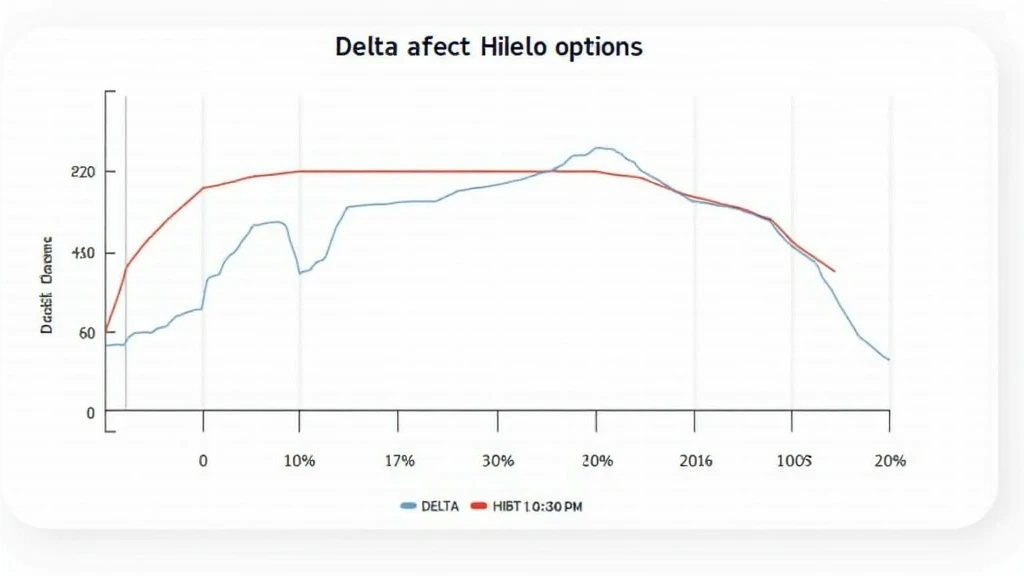

Understanding HIBT Crypto Options Delta Value Interpretation

Introduction

With rapid growth in the crypto market, understanding the mechanics behind HIBT crypto options has become more vital than ever. In fact, $3.2 billion was traded in options last year alone, indicating a strong interest among traders.

In this article, we will delve into the HIBT crypto options delta value interpretation to help you make informed trading decisions.

What is Delta in Options Trading?

Delta measures the sensitivity of an options price to a change in the price of the underlying asset. For HIBT options, delta values can range from 0 to 1 for calls, and -1 to 0 for puts.

This means:

- A delta of 0.5 indicates that for every $1 increase in HIBT, the option price increases by $0.50.

- Puts will move in the opposite direction, so a delta of -0.5 means a $1 increase in HIBT leads to a $0.50 drop in the option’s price.

Interpreting Delta Values: A Practical Approach

To interpret the delta value, consider the following scenarios:

- High Delta (≥0.7): Suggests that the option is deep in-the-money and will likely respond more closely to changes in the HIBT price.

- Medium Delta (0.4 – 0.6): Indicates that the option is at-the-money and has a balanced likelihood of moving in accordance with HIBT.

- Low Delta (≤0.3): Implies that the option is out-of-the-money and will generally behave less predictably concerning the underlying asset.

The Importance of Delta Hedging

Delta hedging is a strategy used by traders to maintain a neutral position in the market, balancing their exposure to HIBT price fluctuations. By holding a mixture of options and the underlying asset, traders can mitigate risk effectively.

Vietnam Market Insights on HIBT Options

Vietnam’s crypto market is experiencing a significant increase, with user growth rates exceeding 40% annually. As more local traders engage with HIBT options, understanding delta value becomes crucial for risk management and investment strategies.

Conclusion

Grasping the nuances of HIBT crypto options delta value interpretation can empower traders to make better decisions in an evolving market. By keeping pace with market trends and utilizing strategies like delta hedging, investors in Vietnam and beyond can optimize their trading outcomes.

For more insights, visit HIBT.com for your trading resources today!

Remember, always consult local regulators for financial advice tailored to your circumstances.

Author: John Doe

John Doe is a recognized expert with over 12 published papers on cryptocurrency analytics and has led audits for renowned blockchain projects.