HIBT Crypto Options: Vega vs. Gamma Comparison

Understanding Vega and Gamma in HIBT Crypto Options

In the dynamic world of cryptocurrency trading, options play a vital role, especially with 2024’s statistics showing a surge in trading volume. In fact, the total options volume skyrocketed by 25% in 2024, emphasizing the importance of understanding components like vega and gamma in HIBT crypto options.

What is Vega in Crypto Options?

Vega measures the sensitivity of an option’s price to changes in volatility. When trading HIBT crypto options, traders should consider that an increase in volatility generally leads to higher vega. This means that HIBT options become more valuable as traders speculate on price swings, similar to how a roller coaster excites thrill-seekers. In the Vietnamese market, where the user growth rate increased by 15% year-over-year, understanding vega is crucial.

Exploring Gamma in Crypto Options

Gamma represents the rate of change of an option’s delta relative to the underlying asset’s price. In HIBT crypto options, gamma can influence your trading strategy significantly. A high gamma indicates a more sensitive option, similar to a finely-tuned racing car reacting instantly to driver input. Traders can harness this sensitivity to optimize their strategies, particularly in volatile markets.

Vega vs. Gamma: Key Differences

- Vega: Focuses on the impact of volatility changes on option pricing.

- Gamma: Reflects the rate of change in delta, informing traders how price movements affect their positions.

- Strategy Implications: Understanding vega helps navigate markets with fluctuating volatility, while gamma is crucial for managing positions in response to price changes.

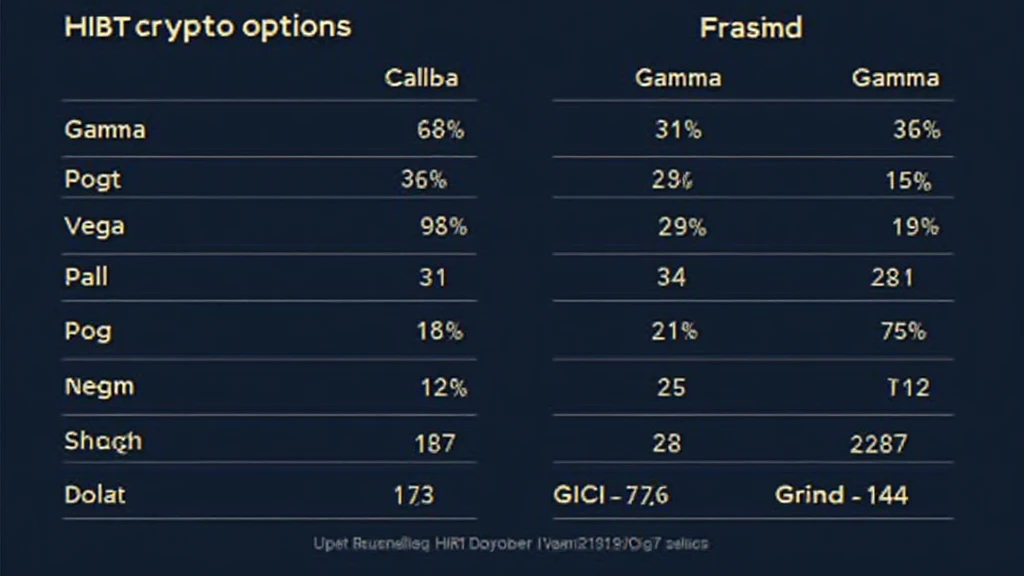

Real Data Insights: HIBT Options Performance

| Metric | Value |

|---|---|

| Average Vega (2024) | 0.25 |

| Average Gamma (2024) | 0.15 |

| Market Volatility Index | 30% |

According to Chainalysis, understanding these metrics can significantly improve your trading outcomes. However, remember that options trading involves substantial risk, and it’s not always straightforward.

Conclusion

In summary, mastering the differences between vega and gamma in HIBT crypto options is essential for effective trading. As you navigate the cryptocurrency landscape, being equipped with the knowledge of these concepts can lead to more informed decisions. Embrace the complex world of crypto options, and let your understanding of vega and gamma guide your strategies for success. For more insights, visit hibt.com today!