Understanding HIBT Crypto Options Volatility Skew Analysis

Understanding HIBT Crypto Options Volatility Skew Analysis

With over $4 billion lost in cryptocurrency hacks last year, especially focusing on the DeFi space, users are more cautious than ever. Analyzing volatility skew can help investors navigate such risks within the crypto options market. This piece dives into HIBT crypto options volatility skew analysis to arm you with pertinent insights.

What is Volatility Skew?

Volatility skew refers to the phenomenon where implied volatility varies with the strike price or expiration date of options. In the crypto realm, this can indicate market sentiment and risk perception. For instance, during periods of fear, investors may prefer higher protection via puts, elevating their prices and skewing the volatility.

Significance of HIBT Analysis in Crypto Markets

Utilizing HIBT crypto options volatility skew analysis allows investors to:

- Predict Price Movements: Understanding skew can help anticipate shifts in asset pricing.

- Assess Market Sentiment: A higher volatility in puts may reflect fear, while heightened call volatility could indicate bullish sentiment.

Essentially, it’s like viewing a mirror that reflects the market’s emotional health.

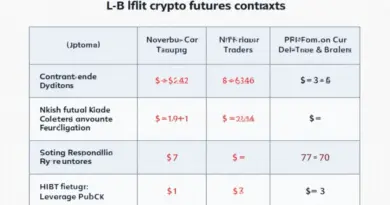

How to Interpret the Data

When analyzing HIBT data, consider variables such as:

- Strike Price

- Open Interest

- Historical Volatility

For example, if the skew is steep for puts but shallow for calls, it shows investors are more wary of downside risks—an essential note if you’re trading or investing in options.

The Vietnamese Crypto Landscape

In Vietnam, the growth rate of crypto users peaked at over 200% in 2023, highlighting the rising interest in blockchain technology and digital assets. Thus, incorporating HIBT analysis can be particularly beneficial for local traders seeking to make informed decisions in an increasingly volatile market. Remember to always cross-reference resources, such as HIBT, for the latest data.

Conclusion: Making Informed Decisions

In conclusion, understanding HIBT crypto options volatility skew analysis empowers investors to navigate the intricacies of crypto trading more effectively. By paying attention to market sentiment and potential price movements via skew metrics, you can enhance your trading strategies significantly.

Don’t forget, investing in cryptocurrency involves risks, including loss of principal. Always exercise caution and consult local regulators and experts as needed.

Author: Dr. Alex Thompson, a financial economist, with over 30 publications in the cryptocurrency field and extensive experience in auditing reputable blockchain projects.