Exploring HIBT Crypto Portfolio Diversification

Understanding Crypto Portfolio Diversification

With rising market volatility and a staggering $4.1 billion lost to DeFi hacks in 2024, investors need to reconsider their strategies. Diversifying your crypto portfolio is not just smart; it’s essential for reducing risk and maximizing potential returns. HIBT crypto portfolio diversification comes into play here—it allows you to spread your investments across a variety of cryptocurrencies, minimizing exposure to any single asset.

Why Diversification Matters

Think of your portfolio like a fruit basket; if one fruit spoils, it doesn’t ruin the entire basket. By diversifying, you ensure that your overall investment remains protected against drastic declines in one area. Studies show that a well-diversified crypto portfolio can yield better long-term results, reflecting a broader and more stable growth pattern.

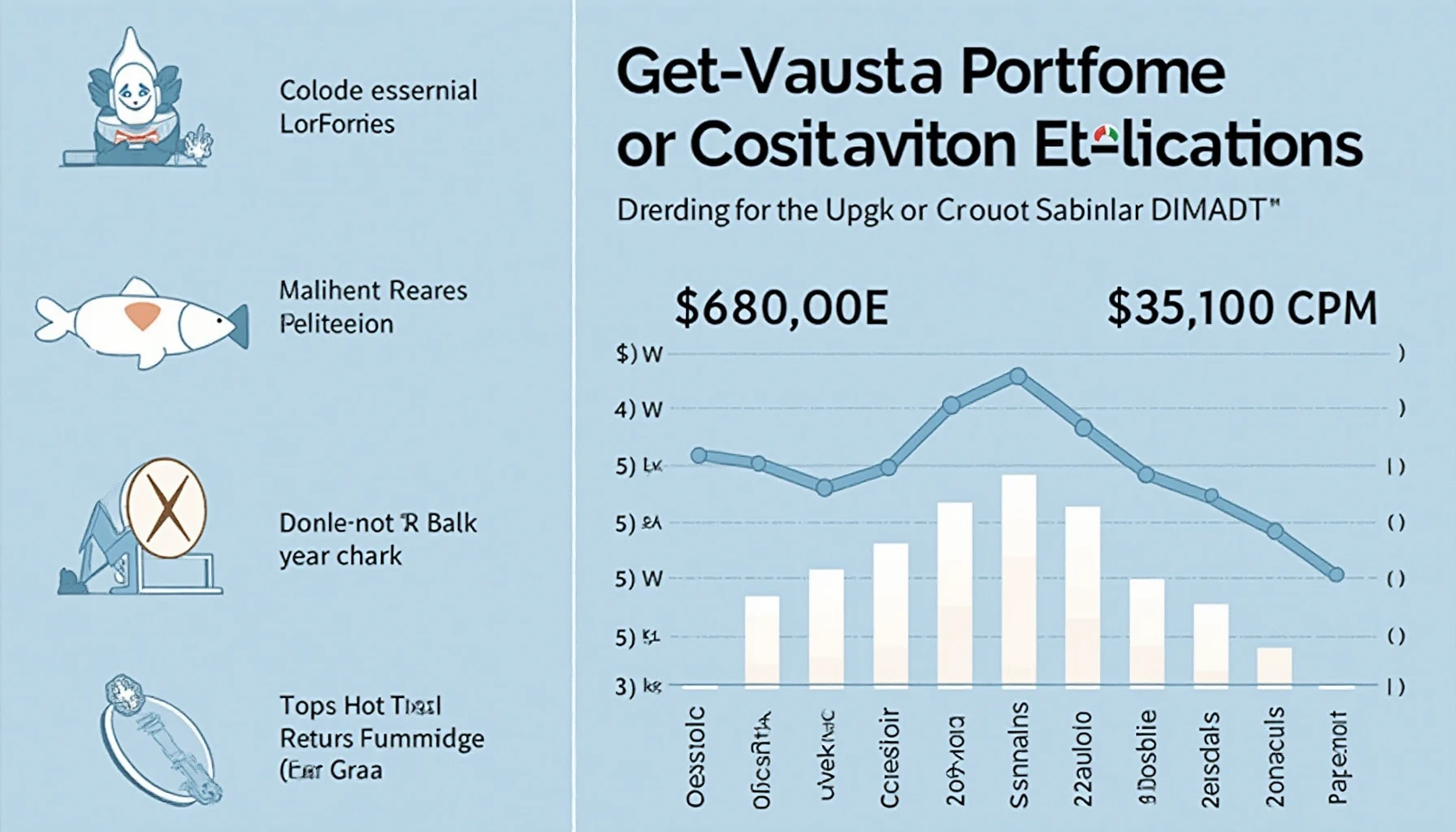

HIBT and Its Role in the Vietnamese Market

Vietnam’s crypto adoption rate has skyrocketed, with user growth reaching over 120% in the last year alone. Incorporating HIBT into your strategy aligns well with this trend. Investors can access various assets that represent both emerging and established cryptocurrencies, thereby improving portfolio robustness.

Strategies for Effective Diversification

- Mixing Major Coins and Altcoins: Combine established cryptocurrencies like Bitcoin and Ethereum with promising altcoins.

- Geographic Diversity: Consider investing in cryptocurrencies popular in different markets, such as Vietnamese tokens.

- Utilizing Stablecoins: Integrate stablecoins into your portfolio to hedge against volatility.

Key Metrics to Evaluate

Before diving into HIBT crypto portfolio diversification, assess the following metrics:

- Market Capitalization: Helps in identifying established players.

- Liquidity: Ensures easy buying and selling of assets.

- Volatility Trends: Research past performance to gauge future scenarios.

Tools for Portfolio Management

Using tools like HIBT Portfolio Tracker can assist in monitoring your diverse investments. It simplifies asset management while providing vital statistics.

Conclusion

In summary, HIBT crypto portfolio diversification is not just a strategic move; it’s a necessity for anyone aiming to thrive in this rapidly changing landscape. By effectively splitting your portfolio across various cryptocurrencies, you not only protect your investment but also set the stage for future growth. The right diversification strategy could significantly enhance your overall investing experience. Remember, consult local regulators to ensure compliance before making investment decisions. Join us at thedailyinvestors.com”>thedailyinvestors for more insights into mastering the crypto world.