HIBT Crypto Portfolio Optimization: A Smart Way to Invest

HIBT Crypto Portfolio Optimization: A Smart Way to Invest

With over $4.1B lost to DeFi hacks in 2024, it’s crucial to understand HIBT crypto portfolio optimization to safeguard your investments. In an ever-evolving digital asset landscape, knowing how to effectively manage your portfolio is essential.

Understanding Portfolio Optimization

Think of your crypto portfolio like a carefully arranged tapestry. Each thread represents a different asset. The goal of portfolio optimization is to weave these threads together for maximum returns while minimizing risk. By analyzing asset performance, you can identify which coins provide the best long-term value.

Key Strategies for HIBT Crypto Portfolio Optimization

- Diversification: Just like you wouldn’t place all your savings in one bank, it’s essential to spread your investments across various cryptocurrencies.

- Regular Audits: Conduct audits to ensure your assets align with market trends. For instance, how to audit smart contracts should be part of your routine assessments.

- Market Analysis: Keep an eye on emerging trends and coins. For example, 2025年最具潜力的山寨币 can diversify your portfolio further.

The Role of HIBT in Portfolio Management

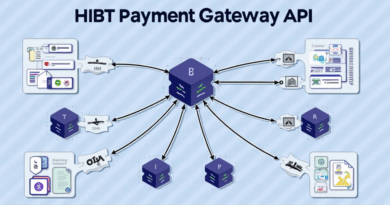

HIBT provides tools and analytics that simplify this process. It assesses risk levels and gives you actionable insights. Just like a bank vault for digital assets, HIBT ensures your holdings are secure while maximizing their potential.

Analytics and Performance Tracking

In Vietnam, the growth rate of crypto users has skyrocketed, particularly among Gen Z investors. With the right tools from HIBT, you can tailor your investments based on localized market trends, ensuring you’re not just following the herd.

Real-World Data Insights

| Year | Users (millions) | Growth Rate (%) |

|---|---|---|

| 2023 | 3.2 | 25 |

| 2024 | 5.0 | 56 |

| 2025 | 7.5 | 50 |

Source: Crypto Market Data 2023

Final Thoughts on HIBT Crypto Portfolio Optimization

By embedding HIBT crypto portfolio optimization strategies into your investment approach, you can better navigate the complexities of the crypto market. Prioritize security, diversify, and stay informed to ensure your portfolio is not just surviving but thriving.

Remember, investing carries inherent risks. Not financial advice. Consult with local regulators for guidelines specific to your region.

For more insights on thedailyinvestors.com/crypto-investing/”>crypto investing, check out our guide on Vietnam crypto tax.

Written by Dr. Nguyen Tran, an expert with over 15 published papers in blockchain technology and the lead auditor for several high-profile projects related to crypto security.