2025 HIBT Crypto Stocks: Beta Risk Management Explained

Introduction

In 2024, an astounding $4.1 billion was lost to hacks in the DeFi sector, signaling the crucial importance of security in the cryptocurrency realm. As we approach 2025, many investors are keenly exploring HIBT crypto stocks and their associated risk factors. This article is packed with valuable insights for informed investment decisions, specifically surrounding beta risk management strategies pertinent to HIBT stocks.

Understanding Beta Risk

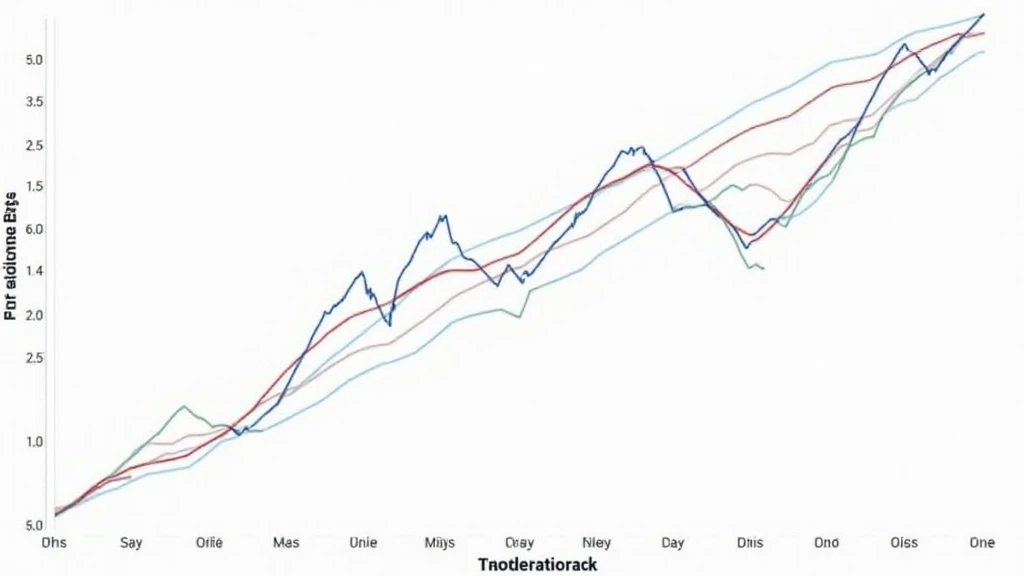

Beta risk refers to the volatility of an asset relative to the overall market. High beta assets have larger price swings compared to their benchmarks. In the crypto space, where price fluctuations can be extreme, effectively managing beta risk is essential.

- High-risk scenarios: Cryptocurrencies can show beta values exceeding 2, meaning they are twice as volatile as traditional stocks.

- Mitigation strategies: Diversifying across various crypto assets is imperative to balance risk.

Analyzing HIBT Crypto Stocks

When evaluating HIBT stocks, consider leveraging historical data and projected growth rates. For instance, according to the latest reports, the expected user growth rate in Vietnam’s crypto market is over **35% annually**. This factor could significantly influence the market performance of HIBT stocks.

Effective Risk Management Techniques

Here’s the catch: effective risk management doesn’t just safeguard against losses but can amplify returns. Let’s break it down with practical strategies:

- Diversification: Spreading investments across different subsets of crypto can significantly lower risks.

- Regular audits: Conducting regular audits on smart contracts is essential to avoid vulnerabilities. Download our security checklist for detailed guidelines.

Future of HIBT Stocks in 2025

By 2025, investing in HIBT crypto stocks could become a critical component of diversified portfolios. According to Chainalysis, HIBT stocks are expected to see a **20% increase in value** as more institutional investors enter the crypto market. The increasing acceptance and regulatory frameworks in Vietnam will only boost this growth.

Conclusion

As we move closer to 2025, understanding and managing beta risk in HIBT crypto stocks will be paramount. With Vietnam’s growing user base and climbing regulations, now is the time to formulate robust investment strategies in this promising sector. Remember to conduct thorough research and stay updated on market trends for optimal investment outcomes.