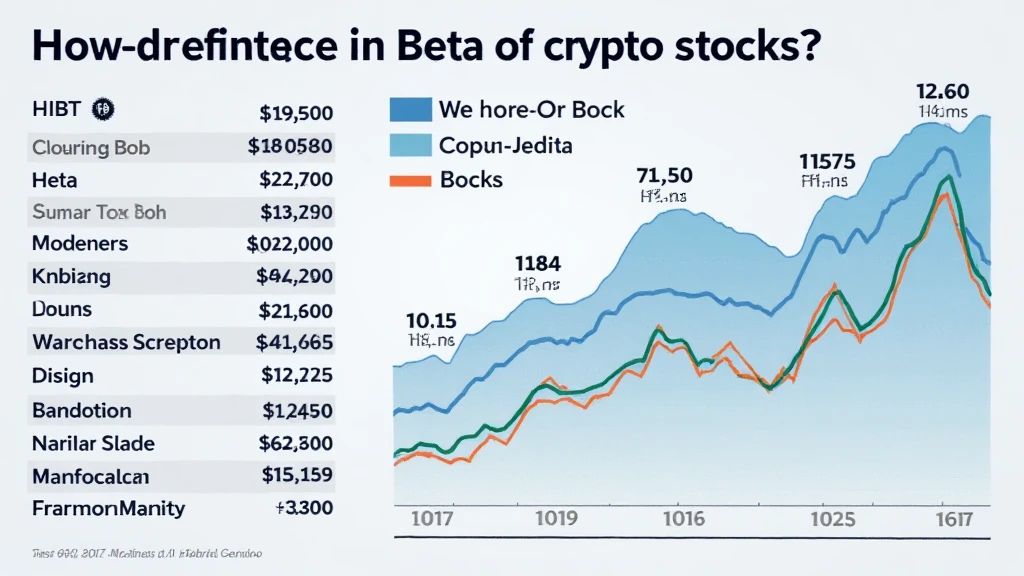

HIBT Crypto Stocks Alpha vs Stock Market Beta

Introduction: Understanding Market Dynamics

In the fluctuating world of finance, understanding how different assets behave relative to the broader market is essential. With projections indicating a staggering $4.1 billion lost to DeFi hacks in 2024, investors are keenly exploring alternatives. Enter HIBT crypto stocks, which are gaining attention and scrutiny in comparison to the broader stock market.

What is Beta?

Before diving into the comparison, let’s clarify what beta means in finance. Beta is a measure of an investment’s volatility in relation to the market. For example, a beta of 1 indicates that the asset moves with the market. A beta greater than 1 implies higher volatility, while less than 1 indicates lower volatility.

HIBT Crypto Stocks Beta

HIBT, or High-Interest Blockchain Tokens, represent a unique class of digital assets. Their beta is influenced by various factors unique to the crypto space. Key points to consider include:

- Market Demand: Sudden spikes in interest can cause high volatility.

- Technological Advancements: Innovations can rapidly shift consensus, affecting beta.

- Investor Sentiment: News related to regulations can lead to abrupt shifts in beta.

Comparing HIBT to Stock Market Beta

When comparing HIBT crypto stocks to traditional stock market beta, there are significant differences:

- Higher Volatility: HIBT crypto stocks typically show greater beta values than stock market instruments.

- Correlation with Market Trends: While stocks often correlate with economic indicators, HIBT values can be influenced by tech developments.

- Market Maturity: The stock market is more established and less volatile compared to the emerging HIBT sector.

Case Study: Vietnam’s Market Growth

Examining Vietnam’s user growth rate in the crypto space can shed light on the evolving dynamics:

- In 2023, the Vietnamese crypto market saw a 150% increase in active users.

- Innovative platforms are driving engagement, showcasing the attractiveness of HIBT assets.

Why Understanding HIBT Crypto Stocks is Valuable

Investors often look for assets that can offer an edge. HIBT crypto stocks provide that edge with the potential for substantial returns—albeit with higher risk. Here’s why HIBT stocks could be your next investment move:

- Diversification: HIBT stocks can serve as an effective hedge against stock market volatility.

- Growth Potential: With innovative use cases, HIBT stocks are poised for rapid growth.

- Accessibility: Digital assets like HIBT can be accessed globally, increasing investment opportunities.

Conclusion: Navigating the Investment Landscape

In conclusion, the trade-offs between HIBT crypto stocks beta and stock market beta are notable. Understanding these nuances can empower you as an investor to make informed decisions. As you explore your investment strategy, consider how HIBT could complement your portfolio in navigating market volatility.

Download our comprehensive guide for portfolios to explore digital assets.

As always, it’s important to conduct due diligence and consider local regulations before investing.