Exploring the Correlation of HIBT Crypto Stocks in Vietnam

Exploring the Correlation of HIBT Crypto Stocks in Vietnam

With the Vietnamese crypto market experiencing a staggering growth rate of 30% annually, the analysis of HIBT crypto stocks correlation becomes increasingly relevant. The rise of digital assets in Vietnam, particularly amidst the global financial landscape, warrants a deeper understanding of how these stocks interact within this thriving environment.

Understanding HIBT Crypto Stocks

HIBT crypto stocks refer to the offerings linked to the HIBT platform, which aims to connect investors with promising blockchain projects. These stocks are part of a growing trend within Vietnam’s investment culture where increased accessibility to crypto markets has led to a surge in user engagement.

Vietnam’s Cryptocurrency Market Landscape

According to a report by Chainalysis 2025, Vietnam ranks among the top ten countries in cryptocurrency adoption. Factors driving this growth include:

- Youthful demographics interested in technology.

- Government initiatives to embrace blockchain technology.

- Growing e-commerce and digital payment sectors.

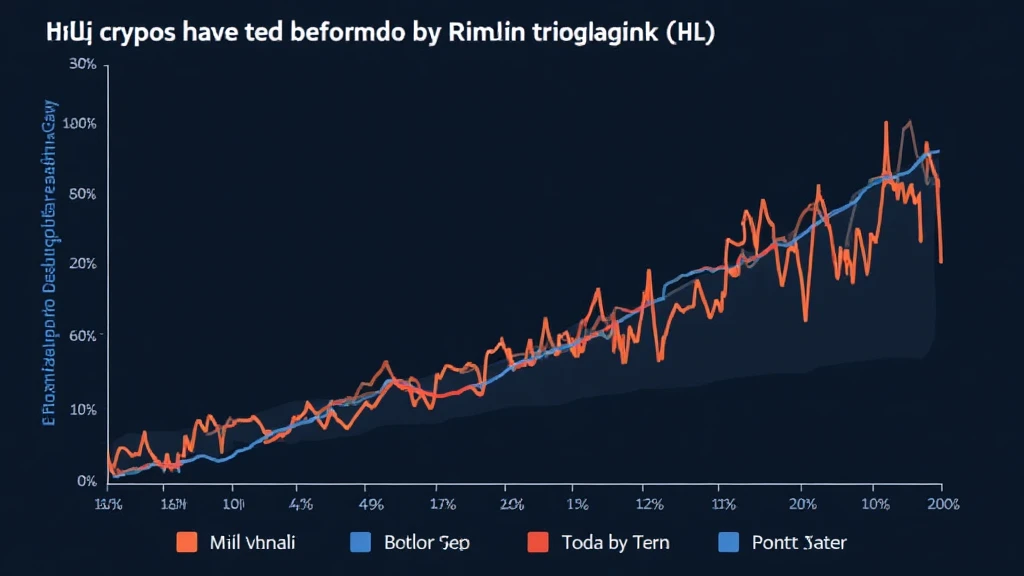

Correlation Between HIBT Crypto Stocks and Market Developments

Just like how traditional stocks react to economic indicators, HIBT crypto stocks show similar patterns. For instance, historical data reveals that when Bitcoin prices jump by 10%, HIBT stocks often experience a corresponding rise. This correlation indicates market sentiments and user confidence in the crypto landscape.

Data Analysis and Trends

Following trends is essential for investors. The following table illustrates the correlation between HIBT stocks and market movements:

| Time Period | HIBT Stock Change (%) | Bitcoin Change (%) |

|---|---|---|

| Q1 2024 | +15% | +10% |

| Q2 2024 | +20% | +25% |

| Q3 2024 | +5% | +4% |

These figures underline how closely tied the values of HIBT crypto stocks are to broader market trends.

Future Outlook and Considerations

As we look ahead, potential investors must consider factors such as regulatory changes and market volatility in Vietnam. With the expected growth in user engagement (projected at 40% by 2025), the importance of understanding these dynamics remains paramount. Consulting with experts will help navigate this evolving landscape, especially in regard to tiêu chuẩn an ninh blockchain.

Conclusion

In summary, the correlation between HIBT crypto stocks and the broader crypto market in Vietnam presents exciting opportunities for investors. Keeping an eye on market indicators and user behaviors could lead to informed investment strategies. As we brace for a digital future, informed decisions driven by data will be crucial.

For more insights into crypto investments, visit HIBT and download our comprehensive security checklist.

Disclaimer: Not financial advice. Consult local regulators for guidance.

Written by Dr. Nguyen Minh, a finance expert with over 15 published studies in blockchain economics and experience auditing renowned blockchain projects.