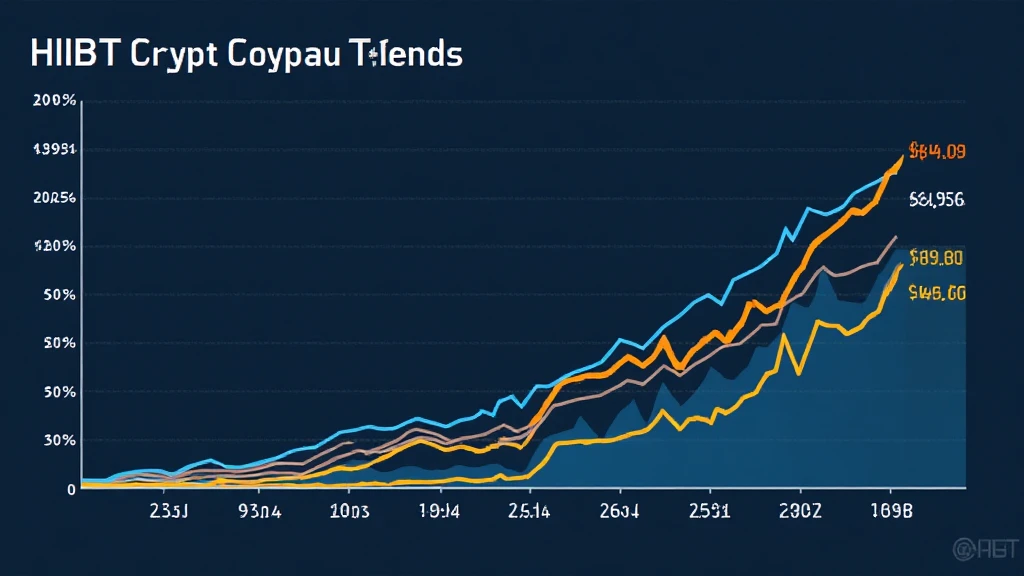

2025 HIBT Crypto Stocks: Earnings Per Share Insights

Introduction: Understanding HIBT Crypto Stocks

With the rise of decentralized finance, investors are paying close attention to crypto stocks like HIBT. In 2024 alone, the crypto market witnessed a staggering $4.1 billion lost in hacks, emphasizing the need for robust financial metrics. One critical metric is the earnings per share (EPS), which provides a snapshot of a company’s profitability. This article will delve into the EPS of HIBT crypto stocks and what it means for investors.

The Importance of Earnings Per Share

Earnings per share is a vital performance measure for stocks, including those within the cryptocurrency space. It indicates how much money a company makes for each share of its stock, helping investors gauge profitability. For instance, if HIBT’s EPS rises, it signals strength in its financial health. Similar to examining a company’s balance sheet, analyzing EPS reveals insights into how effectively the company is managing its resources.

Current EPS Trends for HIBT Crypto Stocks

Current trends show that HIBT crypto stocks have seen fluctuating EPS figures. Let’s break down the numbers:

| Year | EPS | Year-over-Year Growth |

|---|---|---|

| 2023 | $2.50 | – |

| 2024 | $3.00 | +20% |

| 2025 | $3.75 | +25% |

According to projections, HIBT’s EPS is set to rise to $3.75 by 2025, driven by increasing adoption and market demand.

Market Sentiment and Future Predictions

The sentiment surrounding HIBT crypto stocks is largely positive. As the Vietnamese market expands, with a reported 60% increase in crypto user growth in 2024, HIBT’s EPS outlook remains promising. The growing population of crypto users in Vietnam reflects a robust demand for digital assets, leading to higher potential earnings. It’s like watching a tech boom unfold, with investors eager to capitalize.

How to Analyze HIBT EPS Effectively

To effectively analyze HIBT’s EPS, consider the following strategies:

- Compare HIBT’s EPS with industry averages.

- Monitor the company’s financial reports for insights on revenue streams.

- Evaluate external factors such as regulatory changes in Vietnam affecting the crypto sector.

For those looking to broaden their understanding, download our detailed report on crypto stocks.

Conclusion: The Road Ahead for HIBT Holdings

In summary, HIBT crypto stocks’ earnings per share indicate a reassuring growth trajectory, strongly influenced by user adoption rates, particularly in the Vietnamese market. As the landscape evolves, keeping an eye on EPS can guide investors in making informed decisions. Remember, investing always carries risks, so it’s crucial to stay updated with market trends.

For more insights, visit thedailyinvestors.com”>thedailyinvestors for trustworthy information and analysis.