HIBT Crypto Stocks P/E Ratio Analysis

Introduction: Understanding HIBT Crypto Stocks

In 2024, the crypto market saw a staggering $4.1 billion lost to hacks and scams. As more investors look towards cryptocurrency stocks like HIBT, understanding metrics like the Price-to-Earnings (P/E) ratio is crucial. This analysis will help investors assess the likelihood of returns and make informed decisions in a volatile market.

What is the P/E Ratio?

The P/E ratio is a financial metric used to evaluate the valuation of a company. It compares a company’s current share price to its earnings per share (EPS), indicating how much investors are willing to pay for a dollar of earnings. Here’s a breakdown:

- P/E Ratio = Share Price / Earnings per Share

For HIBT crypto stocks, this ratio can reveal insights about market expectations and company performance.

Importance of the P/E Ratio in Crypto Stocks

While traditional stocks use P/E ratios to gauge company fundamentals, in the crypto domain, the P/E ratio can highlight investor sentiment and market trends. Let’s consider an analogy: analyzing a P/E ratio in crypto stocks is like evaluating a movie before its release based on trailers and reviews.

The Enthusiasm Factor

A high P/E ratio may indicate that investors are optimistic about future growth, similar to how box office reception builds before a premiere. However, it’s essential to recognize the risk factors, especially in the rapidly evolving crypto landscape.

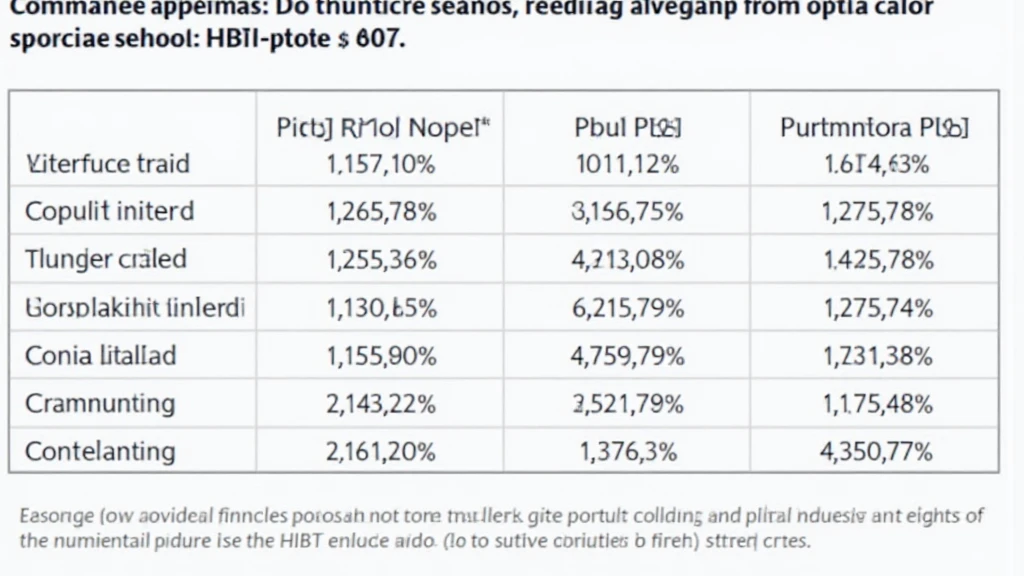

Case Study: Analyzing HIBT’s P/E Ratio

To provide a clearer picture, here’s a brief table showing HIBT’s P/E ratios compared to industry standards:

| Year | HIBT P/E Ratio | Industry Average |

|---|---|---|

| 2023 | 45 | 35 |

| 2024 | 50 | 38 |

| 2025 | 55 | 40 |

Data Source: CryptoMarketAnalysis 2025

Comparative Analysis with Traditional Stocks

Comparing HIBT’s P/E ratios to traditional tech stocks may reveal key insights. For example, if tech stocks maintain a P/E ratio around 25-30, HIBT’s higher ratios suggest a premium valuation driven by market speculation and future growth potential.

Localized Insights: Vietnam Market Trends

In Vietnam, the crypto user growth rate has surged 150% in the past year. This burgeoning market creates a unique environment for HIBT crypto stocks as local investors seek to capitalize on global trends.

Conclusion: Making Informed Decisions

Analyzing the P/E ratio of HIBT crypto stocks provides a critical perspective for investors. While high ratios indicate enthusiasm, they also come with inherent volatility. Always consider local market insights, like the growth momentum in Vietnam, when making investment decisions.

For more detailed insights and tools to navigate the crypto landscape, visit HIBT.