Simplified HIBT Crypto Tax Reporting

Simplified HIBT Crypto Tax Reporting

In 2024, the increasing popularity of cryptocurrencies has led to a staggering $4.1 billion loss from DeFi hacks. As the digital asset market grows, tax reporting for cryptocurrencies, including HIBT, becomes critical for both investors and platforms like thedailyinvestors. Navigating HIBT crypto tax reporting can seem daunting, but understanding the process is essential for compliance and maximization of gains.

Understanding HIBT and Its Tax Implications

HIBT, short for High-Impact Blockchain Tokens, falls under various tax regulations worldwide. According to a recent survey, over 35% of Vietnamese crypto owners expressed confusion regarding tax obligations. This underscores the need for clear guidelines on HIBT crypto tax reporting. And here’s the catch: accurate reporting can help avoid penalties.

Steps for Effective HIBT Crypto Tax Reporting

- Document Transactions: Keep a detailed record of all HIBT transactions, including purchase dates and prices.

- Calculate Gains and Losses: Determine gains by subtracting the purchase price from the selling price for each transaction.

- Consult Local Regulations: As tax laws vary by location, consider consulting a tax professional who understands Vietnamese laws around crypto.

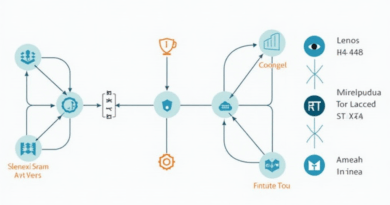

Utilizing Tools for HIBT Tax Reporting

Just like a bank vault for digital assets, utilizing tools such as tax software can dramatically simplify HIBT crypto tax reporting. For instance, using tools designed to track digital assets can save time and reduce errors.

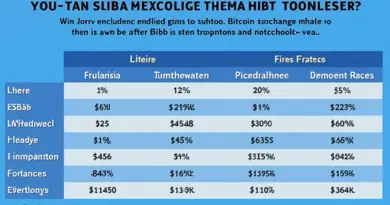

Key Tools for Crypto Tax Solutions

- Crypto Tax Software: Examples include CoinTracker and Koinly, which streamline the process.

- Blockchain Explorers: Tools like Etherscan help individuals verify transaction history accurately.

Tax Reporting Trends in Vietnam

In Vietnam, the rapid growth of crypto users is expected to increase by 64% in 2025. This surge highlights the urgent need for effective tax reporting strategies. Investors should stay ahead of tax legislation developments and compliance updates.

Future Trends Post-2025

- Increased Regulation: As governments around the world tighten regulations on crypto, expect more stringent tax measures.

- Blockchain Adoption: Companies may integrate advanced solutions for seamless HIBT tracking and tax calculations.

Conclusion

In summary, understanding HIBT crypto tax reporting is essential for anyone involved in the digital asset landscape. By keeping thorough transaction records and leveraging modern tax tools, investors can ensure compliance and navigate the complexities of tax obligations successfully. As regulations evolve, always check for the latest updates in HIBT crypto tax practices.

For more insights, download our crypto tax checklist and ensure your reporting is compliant as you grow your cryptocurrency portfolio.

Stay informed and excel in the crypto world with thedailyinvestors.