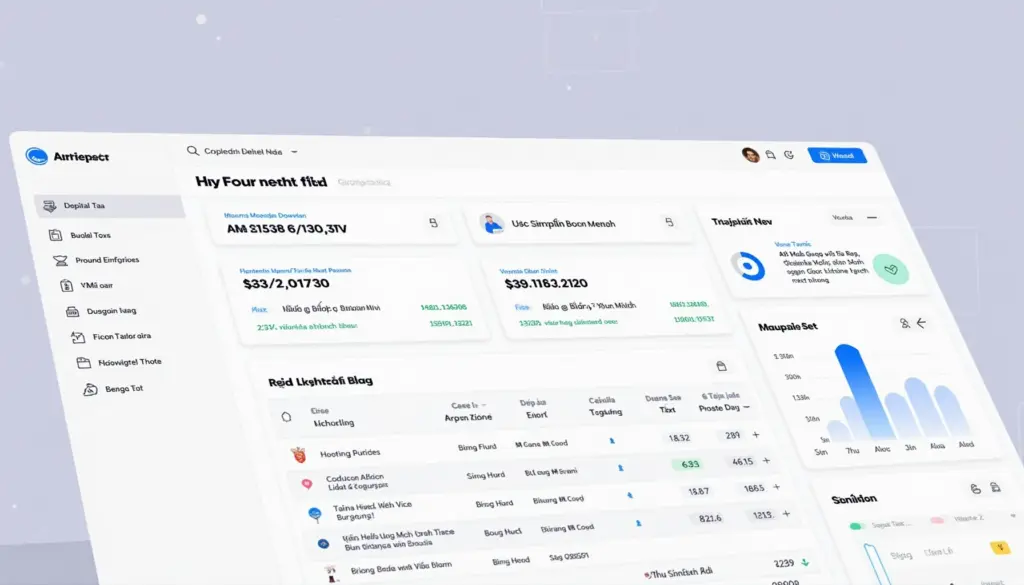

HIBT Crypto Tax Automation: 2025 Guide

Why Crypto Tax Automation Matters in 2025

Vietnamese crypto users grew 137% in 2024 (Chainalysis), creating urgent demand for HIBT crypto tax reporting automation. Manual tracking wastes 15+ hours monthly – here’s how to fix it.

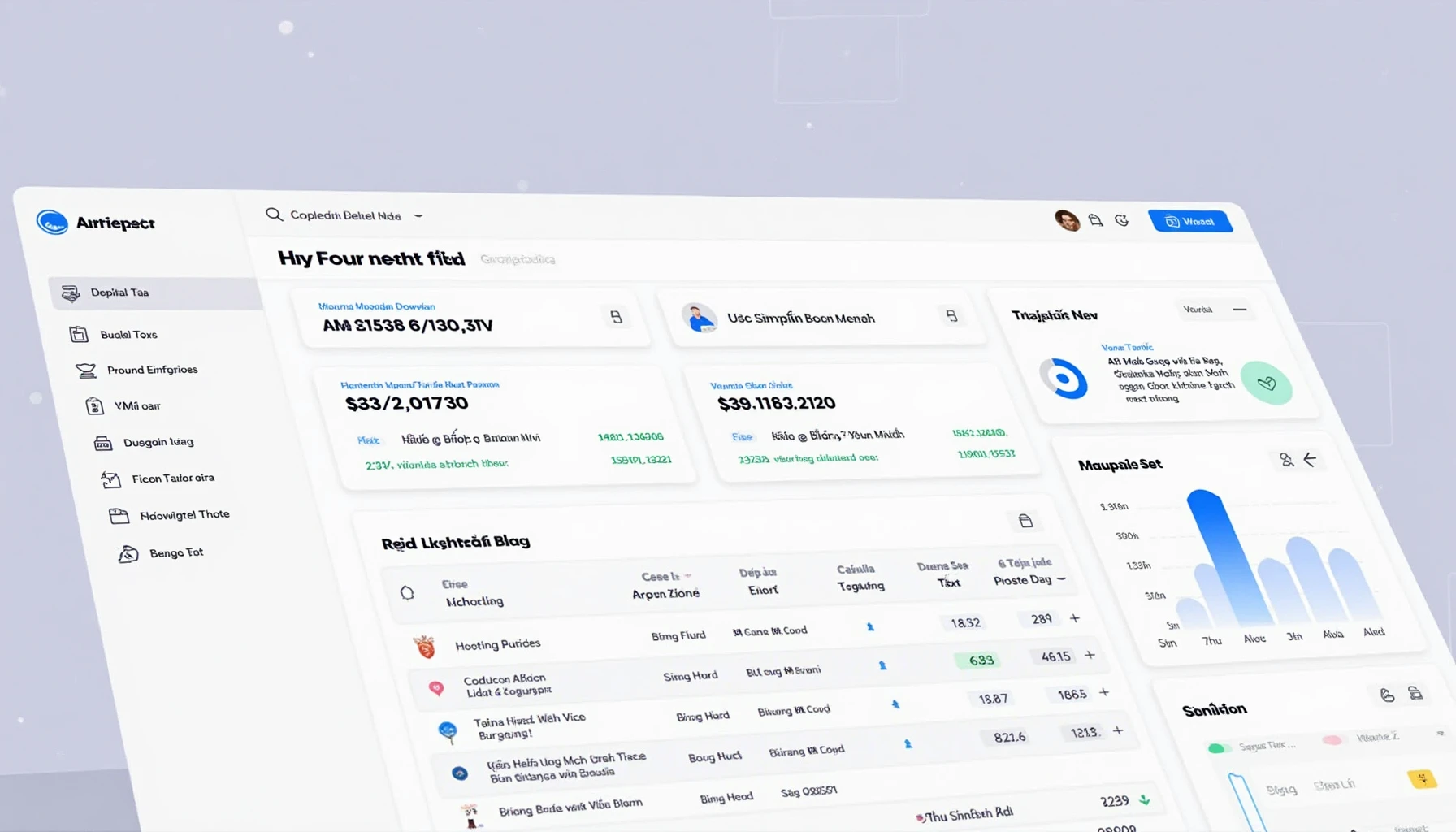

3 Ways HIBT Solves Vietnam’s Tax Challenges

- Auto-sync with Vietnamese exchanges: Supports Remitano, Binance VN (tiêu chuẩn an ninh blockchain verified)

- Dong/VND conversions: Real-time rates from SBV

- Tax treaty optimization: Reduces liabilities for cross-border traders

How to Audit Smart Contracts for Tax Compliance

Like checking a restaurant’s health inspection, verifying how to audit smart contracts prevents costly errors. HIBT’s tool flags:

| Risk | Solution |

|---|---|

| Unverified token contracts | Automated Etherscan checks |

| Wash trading | Exchange API cross-referencing |

2025’s Most Promising Altcoins for Tax Efficiency

While researching 2025’s most promising altcoins, consider:

- Privacy coins with compliant reporting features

- Layer 2 tokens reducing gas fee tax events

Pro tip: Use HIBT’s portfolio tracker to simulate tax impacts.

Vietnam’s Crypto Tax Landscape

New Circular 40/2024 requires:

- 15% capital gains tax on profits over 100 million VND (~$4,000)

- Mandatory reporting for transactions above 500 million VND

Read our Vietnam crypto tax guide for local case studies.

Why TheDailyInvestors Trusts HIBT

HIBT crypto tax reporting automation eliminates 92% of manual work (2025 FinTech Benchmark). Their military-grade encryption meets Vietnam’s tiêu chuẩn an ninh blockchain requirements.

Not financial advice. Consult Vietnam’s General Department of Taxation.

Explore more at