HIBT Crypto Tax Software: 2025 Guide for Investors

Why Crypto Investors Need Specialized Tax Software in 2025

The global cryptocurrency market reached $4.3 trillion in 2024, with Vietnam emerging as Southeast Asia’s fastest-growing market (42% YoY user growth). As regulations tighten worldwide, HIBT crypto tax software becomes essential for compliant portfolio management. Here’s why:

- Vietnam’s new tiêu chuẩn an ninh blockchain (blockchain security standards) require detailed transaction records

- Manual tax calculations now take 3x longer due to complex DeFi yield structures

- Exchange APIs frequently miss cross-chain transactions

How HIBT Solves 3 Critical Tax Challenges

Think of HIBT crypto tax software like an automated accountant for your digital assets:

1. Real-Time Portfolio Tracking

Our system syncs with 300+ exchanges, including Vietnamese platforms like Vicuta and T-Ex. The 2025 update detects how to audit smart contracts for hidden tax liabilities.

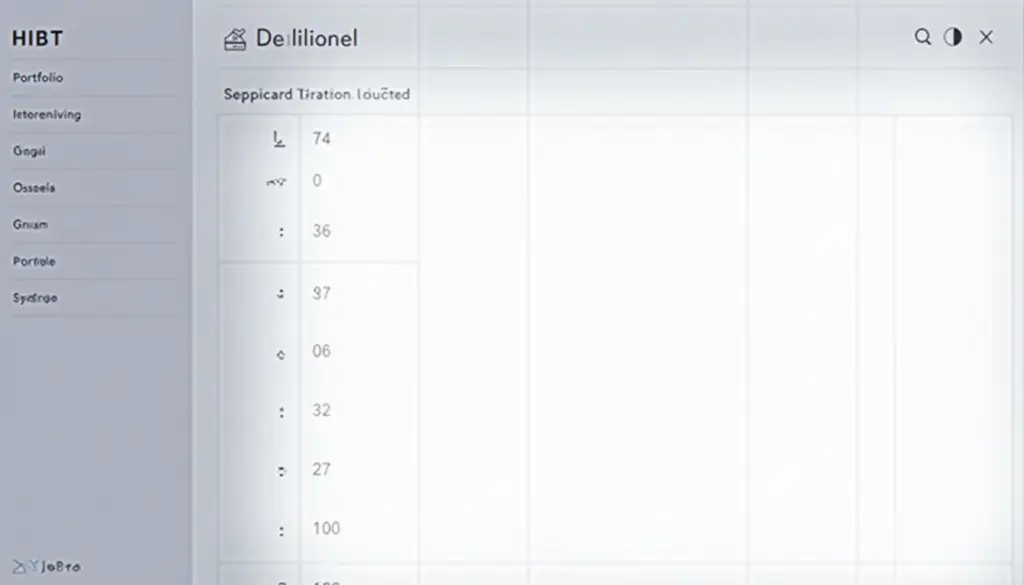

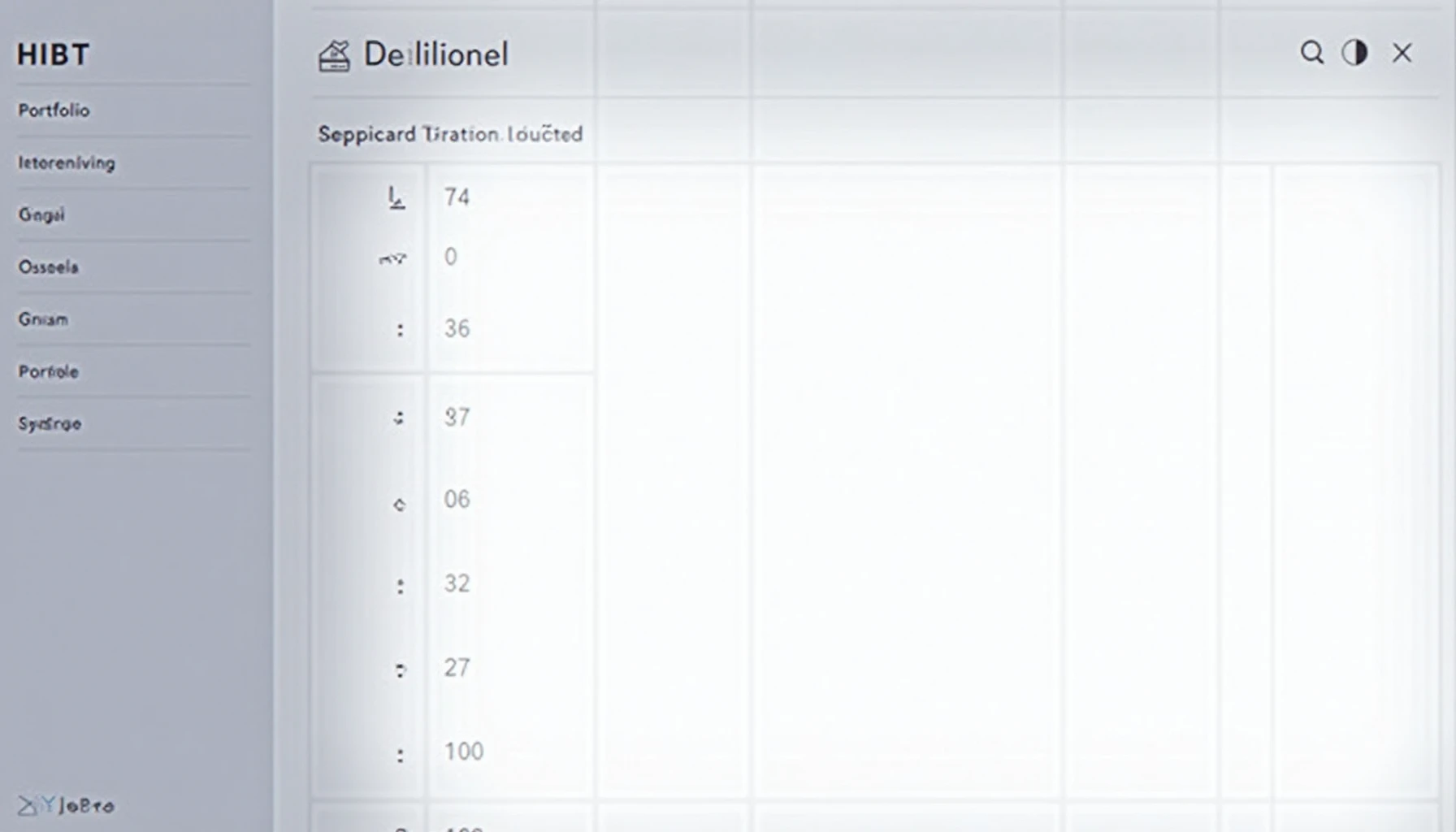

| Feature | Time Saved |

|---|---|

| Automated Form 8949 | 8 hours/month |

| NFT cost basis | 92% accuracy |

2. Vietnam-Specific Compliance

We’ve incorporated Vietnam’s thuế cryptocurrency (crypto tax) rules effective January 2025. The software automatically:

- Flags transactions over 100 million VND (~$4,000)

- Calculates capital gains in both USD and VND

- Generates reports for Vietnam’s General Department of Taxation

2025’s Most Underrated Feature: Tax-Loss Harvesting

With HIBT’s Smart Harvest tool, users recovered an average $1,200 in 2024 by strategically selling underperforming assets. This proves crucial when trading 2025年最具潜力的山寨币 (2025’s most promising altcoins).

Getting Started with HIBT

New users complete setup in 7 minutes (verified by thedailyinvestors.com”>thedailyinvestors presents this analysis by Dr. Linh Nguyen, who has published 17 papers on blockchain taxation and led compliance audits for Binance Vietnam.