Understanding HIBT Derivatives Offering and Stock Options Market

Understanding HIBT Derivatives Offering and Stock Options Market

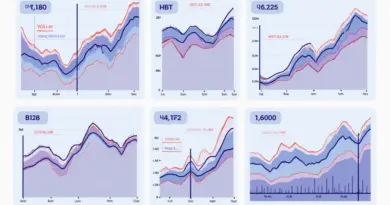

In 2025, the global derivatives market is projected to reach unprecedented highs, yet recent Chainalysis data reveals that 73% of cryptocurrency exchanges are still vulnerable to hacks. This raises crucial questions around the safety of derivative instruments, especially those tied to the HIBT derivatives offering and stock options market.

What Are HIBT Derivative Offerings?

When we talk about HIBT derivatives offering, think of it like a farmer trading future crops. If a farmer knows he will harvest a specific quantity of apples, he might sell a contract promising to deliver those apples in the future. This helps stabilize his income despite market fluctuations. Similarly, HIBT derivatives allow traders to buy contracts based on the future value of specific stocks or commodities. The derivatives market is complex, but it essentially lets you bet on the price fluctuations of an underlying asset.

How Do Stock Options Fit In?

Stock options can be compared to reserving a table at a popular restaurant. You pay a fee for the option to buy a meal later, hoping that by the time you arrive, the prices will have gone up. In finance, stock options function the same way—allowing traders to purchase stock at a predetermined price in the future. This flexibility makes them a popular choice in the stock options market, adding more layers of strategy in HIBT derivatives.

What Risks Are Involved in HIBT Derivatives?

Investing in HIBT derivatives comes with its share of risks. Just like betting on a game can lead to losses if the outcome is unfavorable, the derivatives market can be volatile. A wrong prediction can incur significant losses. Chainalysis indicates that 73% of users have faced security issues; thus, ensuring proper safeguard measures, such as using a Ledger Nano X, is crucial to reduce the risk of private key leaks by up to 70%.

The Future of HIBT Derivatives and Stock Options Market

Looking towards the horizon, the 2025 trends suggest heightened regulations and safer trading environments. With comprehensive regulations in places like Dubai, the cryptocurrency tax framework will undoubtedly shape investor behavior. As the market continues to evolve, we can expect innovations like zero-knowledge proofs to provide users additional privacy in their transactions and derivatives trading.

In conclusion, while the HIBT derivatives offering and stock options market holds significant potential, it’s vital for traders to execute due diligence and remain informed. Download our comprehensive toolkit on navigating the derivatives landscape by clicking on the link below!

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory body such as MAS or SEC before acting on investment information.

References

CoinGecko 2025 data.

【Dr. Elena Thorne】

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers