The Future of HIBT Exchange Ecosystem Health and Corporate Stock Management

The Future of HIBT Exchange Ecosystem Health and Corporate Stock Management

According to Chainalysis 2025 data, a staggering 73% of decentralized finance (DeFi) platforms are facing significant security vulnerabilities. This alarming statistic highlights the importance of robust ecosystems like HIBT, which aim to ensure not only the health of decentralized exchanges but also the financial well-being of corporate stocks in an ever-evolving market.

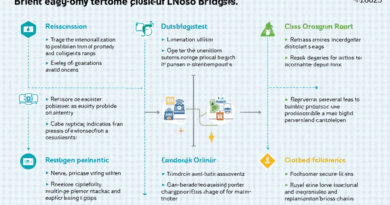

What is the HIBT Exchange Ecosystem?

Think of the HIBT exchange ecosystem as a bustling marketplace where various digital currencies are traded safely, similar to a local farmer’s market where fresh produce is exchanged for goods. The key to this ecosystem thriving lies in its ability to operate across different blockchain networks – a feature known as cross-chain interoperability. This enables users to seamlessly transfer assets, ensuring liquidity and enhancing exchange efficiency.

How is Corporate Health Related to Exchange Ecosystem Health?

Just like how tending to plants in a garden reflects the health of the overall ecosystem, the well-being of corporate stocks is closely tied to the HIBT exchange ecosystem. A strong and secure exchange environment helps stabilize stock values by ensuring smoother transactions and reliable trading mechanisms. As we advance towards 2025, investors will prioritize platforms that guarantee a robust framework for corporate assets to flourish.

Key Benefits of Zero-Knowledge Proof Applications

Zero-knowledge proofs can be likened to a situation where you need to prove to a bakery that your order is correct without revealing all the details. In the HIBT ecosystem, these applications enhance privacy and security, allowing secure transactions without exposing personal data. This technology could revolutionize how businesses handle sensitive information, making operations not only more efficient but compliant with regulations.

The Future of Compliance in the HIBT Ecosystem

As we move into 2025, regulatory trends in places like Singapore will have significant implications for the HIBT network. With authorities keen on ensuring that DeFi complies with financial regulations, platforms that integrate compliance measures into their framework will gain a competitive edge. Investing in regulatory-friendly frameworks is akin to building a foundation for a house; without it, the entire structure can collapse.

In conclusion, as the HIBT exchange ecosystem continues evolving, its health and the corporate stock landscape are bound to intertwine more closely. This synergy fosters trust among users and investors alike. For a deeper understanding of how to navigate these complexities, download our comprehensive toolkit at hibt.com.

Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities before making any investment decisions (e.g., MAS/SEC).

Tools like the Ledger Nano X can reduce the risk of private key leakage by up to 70%, ensuring that your investments remain protected.

For in-depth analyses and updates, stay connected with us at The Daily Investors.