Understanding HIBT Exchange Hacking Incidents and Stock Regulatory Incidents

Understanding HIBT Exchange Hacking Incidents and Stock Regulatory Incidents

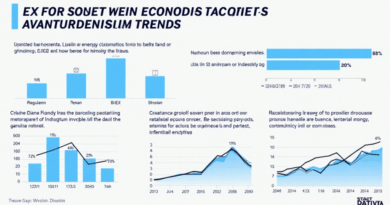

According to Chainalysis data from 2025, a staggering 73% of crypto exchanges exhibit security vulnerabilities, raising eyebrows on the safety of investments.

What Are HIBT Exchange Hacking Incidents?

Ever tried to buy some fruits but found out someone had sneaked off with the best ones? Just like that, HIBT exchange hacking incidents involve malicious actors stealing digital assets from exchanges. These breaches often lead to significant financial losses, as seen in high-profile cases. Just this year, several exchanges reported breaches that compromised user funds, shaking confidence in the sector.

How Do Stock Regulatory Incidents Affect the Market?

Think of stock regulatory incidents like a local market shutting down for not following health codes. If exchanges don’t comply with regulations, it can impact their licenses and operations. The SEC and other regulatory bodies are pushing harder for compliance, and any lapses can lead to trading suspensions or fines, significantly affecting stock prices. For instance, recent incidents have highlighted the need for transparency and accountability in the trading environment.

Can Cross-Chain Interoperability Mitigate These Risks?

You know how you can exchange cash at a currency booth effortlessly? Cross-chain interoperability aims to do just that for digital currencies. With the rise of decentralized platforms, the ability to transfer assets across different blockchains without compromising security is crucial. By utilizing protocols, HIBT exchanges can enhance user trust and reduce the likelihood of hacking incidents.

What Role Do Zero-Knowledge Proofs Play?

Picture shopping without revealing your entire shopping list—just showing what’s necessary. Zero-knowledge proofs allow transactions to be verified without disclosing all transaction details, thus enhancing user privacy and security. Their application can significantly reduce the attack surface, benefiting both exchanges and regulatory compliance. This technology is gaining traction as a potential solution to the rising concerns regarding digital asset security.

In conclusion, as we navigate the complexities of HIBT exchange hacking incidents and stock regulatory matters, it’s essential to stay informed and proactive. Download our toolkit to better protect your investments today!

Disclaimer: This article does not constitute investment advice. Please consult local regulatory bodies before making any financial decisions, such as MAS or SEC. Tools like Ledger Nano X can help reduce the risk of your private keys being compromised by 70%.

For more insights on cross-chain security, check our detailed whitepaper and stay updated with our blog on latest regulatory trends in the cryptocurrency market.

Authored by: Dr. Elena Thorne, Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Published 17 IEEE Blockchain Papers