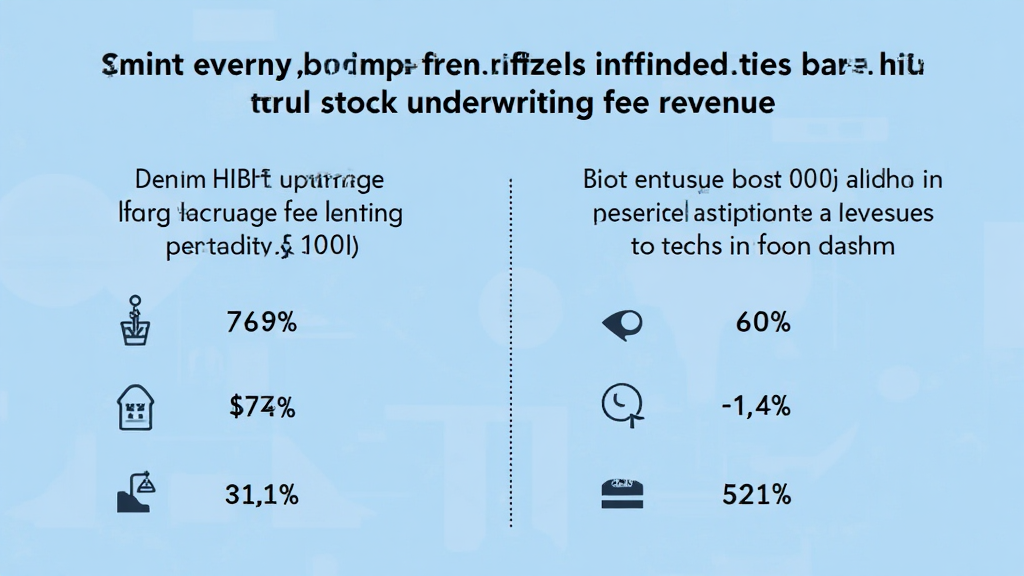

Understanding HIBT Exchange Listing Fee and Stock Underwriting Fee Revenues

Understanding HIBT Exchange Listing Fee and Stock Underwriting Fee Revenues

According to Chainalysis 2025 data, a staggering 73% of exchanges face challenges with listing fees and underwriting practices, which can significantly impact their operational efficiency and revenue streams. As the cryptocurrency landscape evolves, the connection between HIBT exchange listing fee revenue and stock underwriting fee revenue is becoming increasingly crucial for investors and businesses alike.

What is the HIBT Exchange Listing Fee Revenue?

Think of HIBT exchange listing fees as the entry ticket for a concert. Just like a popular band requires you to buy a ticket to see them live, exchanges charge a fee for new tokens to be listed. This fee generates revenue for the exchange, which can be a significant income source. As the crypto market grows, understanding how these fees are structured can help businesses strategize their entry into this digital domain.

How Does Stock Underwriting Fee Revenue Work?

Imagine you’re baking cookies for a neighborhood bake sale. You’ll need some help to sell them, which includes finding the right buyers and setting fair prices. In the financial world, stock underwriting fees function similarly. When a company wants to go public, underwriters help them by purchasing their shares and selling them to the public. In return, the underwriters earn a fee, creating another revenue stream vital for financial stability.

The Impact of HIBT Fees on Investor Decisions

Investor decisions can be compared to a grocery shopping list. When you visit the store, you want to know the prices of items to make informed choices. Similarly, investors look at HIBT exchange listing fee revenue and stock underwriting fees to gauge the health of a platform before committing resources. A clear understanding of these fees provides a window into the operational aspects of exchanges.

Future Trends for HIBT and Stock Underwriting

Looking ahead to 2025, trends such as increased regulatory oversight and refined fee structures will significantly affect HIBT revenues. Local markets, like the emerging crypto regulatory landscape in Dubai, are adapting, which could lead to innovative fee models. Investors should stay vigilant about changes that can impact their investment strategies and potential returns.

In conclusion, the HIBT exchange listing fee revenue and stock underwriting fee revenue are intertwined complexities that can determine the success of trading environments. To stay ahead in this digital age, it’s crucial to remain informed and adaptable.

For more insights, don’t forget to download our comprehensive toolkit on cryptocurrency revenue strategies!

Check out our white paper on exchange security, and always ensure you consult your local regulatory bodies like MAS or SEC before making any investment decisions.

Risk Disclaimer: This article is for informational purposes and does not constitute investment advice.