Understanding HIBT Exchange Peer-to-Peer Model and Stock Peer-to-Peer Model

Exploring the HIBT Exchange Peer-to-Peer Model and Stock Peer-to-Peer Model

According to 2025 data from Chainalysis, over 73% of cross-chain bridges have security vulnerabilities. Investors are increasingly worried about the implications of these weaknesses on asset management and trades. This is where concepts like the HIBT exchange peer-to-peer model and stock peer-to-peer model become crucial for both seasoned traders and newcomers alike.

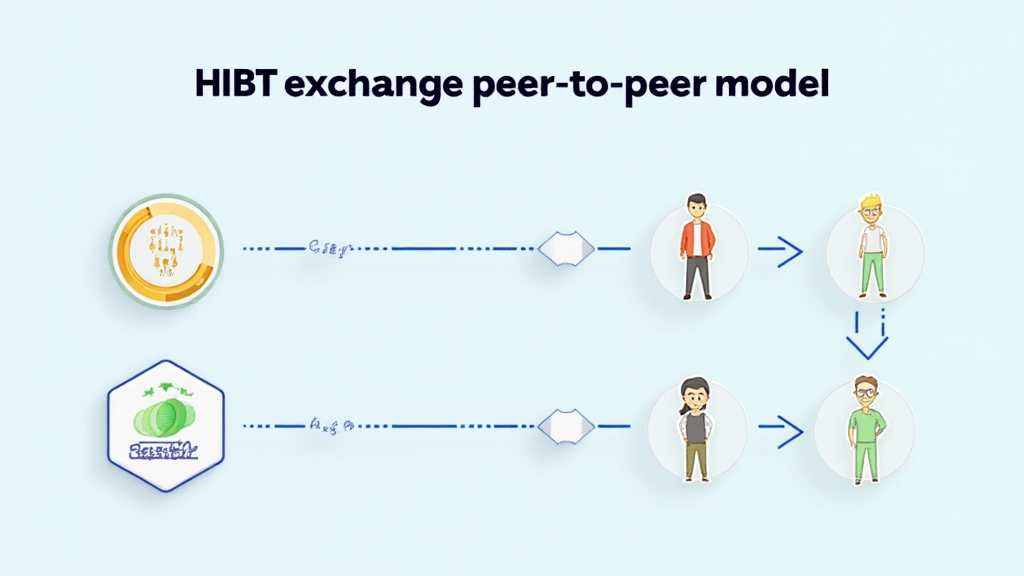

What is the HIBT Exchange Peer-to-Peer Model?

Think of the HIBT exchange peer-to-peer model as a marketplace where individuals can trade assets directly with one another, similar to how you swap fruits at a local market. For instance, instead of going through a centralized exchange (like a big supermarket), you can negotiate and trade directly with another person. This model eliminates transaction fees and increases the efficiency of trades. In a decentralized world where privacy and speed are priorities, adopting this model can significantly enhance user experience.

Understanding the Stock Peer-to-Peer Model

Now, let’s dissect the stock peer-to-peer model. Imagine you want to buy a stock. Instead of going to an intermediary who charges you a fee, you go straight to the individual who owns the stock, much like trading Pokémon cards with your friend directly. This system improves accessibility and reduces costs associated with trading stocks. More investors are turning to this model to discover hidden opportunities in the market.

How Do Cross-Chain Interoperability and Zero-Knowledge Proofs Fit In?

Cross-chain interoperability can be likened to being able to use your cash at various stores without needing to convert currencies. It allows different cryptocurrencies to communicate with each other seamlessly. Zero-knowledge proofs (ZKP) add an extra layer of privacy to transactions, ensuring you can validate information without revealing the actual data. This is increasingly vital as concerns over privacy and security grow in the digital trading landscape.

Regional Insights: A Glimpse into Dubai’s Cryptocurrency Tax Guidelines

In regions like Dubai, the regulatory environment for cryptocurrency trading is becoming clearer as we move towards 2025. Understanding these guidelines is crucial for investors engaging with the HIBT exchange peer-to-peer model and stock peer-to-peer model, as compliance with local laws becomes an integral part of safe trading strategies.

Conclusion

As peer-to-peer models evolve, investors must stay informed about their advantages and challenges. With tools like Ledger Nano X, users can significantly reduce the risk of key theft by up to 70%. If you’re interested in diving deeper into this topic and securing your investments, download our toolkit now.

Risk Statement: This article does not constitute investment advice. Always consult local regulating bodies like MAS or SEC before making any trades.

Stay updated with the trends in the financial world at thedailyinvestors.