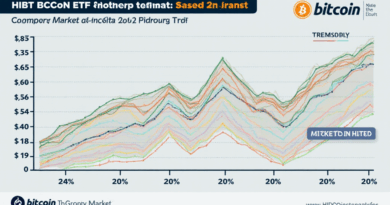

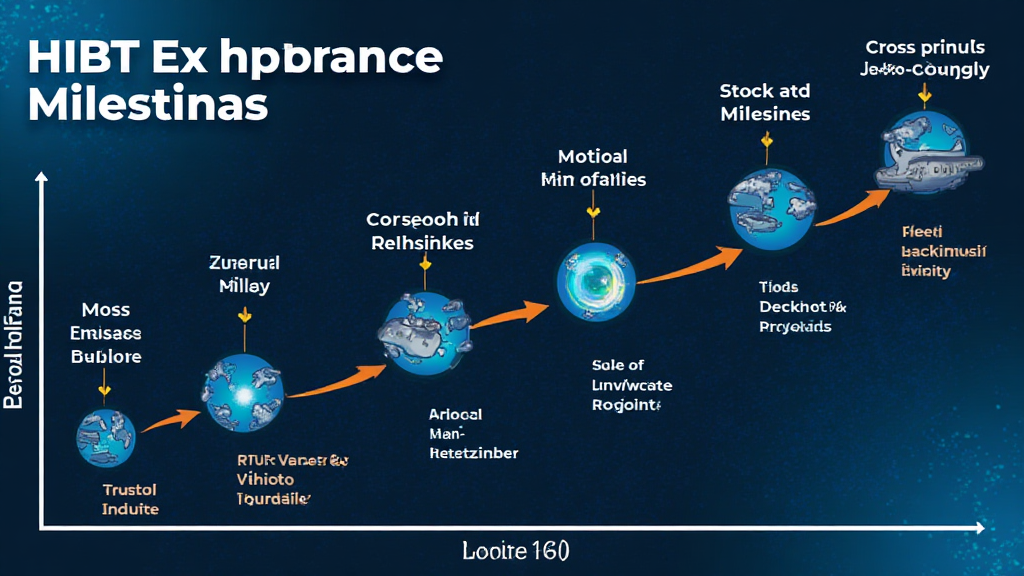

2025 HIBT Exchange Roadmap Milestones vs Stock Earnings Milestones

2025 HIBT Exchange Roadmap Milestones vs Stock Earnings Milestones

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges display vulnerabilities, presenting a significant challenge for cryptocurrency traders and stakeholders. Understanding the HIBT exchange roadmap milestones versus stock earnings milestones can help investors navigate this complex landscape.

What are HIBT Exchange Roadmap Milestones?

The HIBT exchange roadmap is akin to a community shopping guide, indicating key advancements in cryptocurrency trading technology. For example, consider how markets enable cross-chain interoperability—it’s like a currency exchange kiosk in a bustling area. Each milestone, such as implementing zero-knowledge proofs to enhance transaction privacy, helps to establish trusted transactions across different blockchains. This increases user confidence and streamlines trading.

Why Stock Earnings Milestones Matter?

Stock earnings milestones are critical benchmarks for assessing company performance. When looking at HIBT exchange roadmap milestones vs stock earnings milestones, investors can evaluate how advancements in blockchain technology influence the market. Think of it as a race, where companies that innovate faster are more likely to attract investors. For instance, upcoming earnings reports can show whether adopting decentralized finance (DeFi) practices boosts performance.

Challenges in Comparing Roadmap and Earnings Milestones

While comparing HIBT exchange roadmap milestones vs stock earnings milestones may seem straightforward, complexities arise. Picture it like comparing apples and oranges; both are fruits, yet they serve different purposes. The risk of technological overreach in earnings performance is a valid concern, as regulatory approaches, such as Singapore’s 2025 DeFi regulation trend, can impact operational viability.

Investing Strategies: HIBT vs Traditional Stocks

As an investor, you might wonder how to leverage insights from HIBT exchange roadmap milestones. It’s similar to choosing between traditional markets and emerging crypto markets. For example, the PoS mechanism’s energy consumption comparison can guide investors looking to support sustainable projects. Adopting well-rounded strategies that blend both realms can yield favorable outcomes.

In conclusion, understanding HIBT exchange roadmap milestones versus stock earnings milestones is crucial for informed investing. As you prepare for the dynamic 2025 market, don’t forget to download our essential toolkit for traders, which includes security tips and best practices.

For more insights, check out our roadmap white paper and see how these developments can shape the future.

Risk Disclosure: This article does not constitute investment advice. Consult local regulatory authorities, such as MAS or SEC, before making investment decisions.

To secure your assets, consider using a Ledger Nano X to reduce the risk of private key exposure by up to 70%.