Understanding HIBT Exchange Token Burn Strategy in 2025

Introduction: A Market Vulnerability

According to Chainalysis data from 2025, a staggering 73% of crypto exchanges are fraught with vulnerabilities. Among these, the HIBT exchange has garnered attention not just for its trading options but for its unique token burn strategy coupled with stock share buy-back plans. This article dives into how these strategies could reshape investor confidence and market stability.

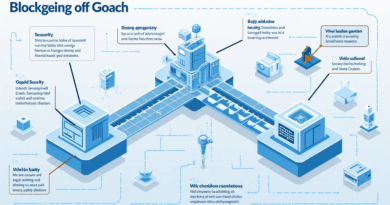

What is the HIBT Token Burn Strategy?

Imagine a bustling market where vendors decide to reduce their merchandise to create more value. The HIBT token burn strategy works similarly. By systematically removing tokens from circulation, the exchange aims to increase scarcity, thereby potentially elevating the token’s value. This approach can remind you of how vendors at a lower price can drive supply down, making each item more coveted.

How Does the stock share buy-back Strategy Work?

Think of stock share buy-backs like a baker deciding to buy back half of his unsold bread. He does this to increase the quality and demand for what he has left. In 2025, HIBT’s strategy will involve purchasing its own shares from the market, effectively boosting the value of remaining shares. This can create a win-win scenario for investors, making existing shares more valuable and signaling confidence in the company.

Potential Impact on Investors

For investors, the combined effect of the token burn strategy and stock share buy-back strategy could be akin to discovering that their favorite café offers seasonal discounts. Not only do the strategies aim to enhance the intrinsic value of holdings, but they also provide reassurance about the company’s health and future prospects. In a time where the crypto landscape is continuously evolving, these strategies can add a layer of trust and transparency.

Conclusion and Actionable Insights

In conclusion, the HIBT exchange token burn strategy in 2025 and the stock share buy-back strategy together create a compelling narrative for investors. The potential for increased value and the strategies’ focus on enhancing shareholder confidence align well with market needs. Download our comprehensive toolkit for further insights, which also includes best practices for managing your crypto investments.