2025 HIBT Exchange Valuation and Stock Valuations Insights

Introduction

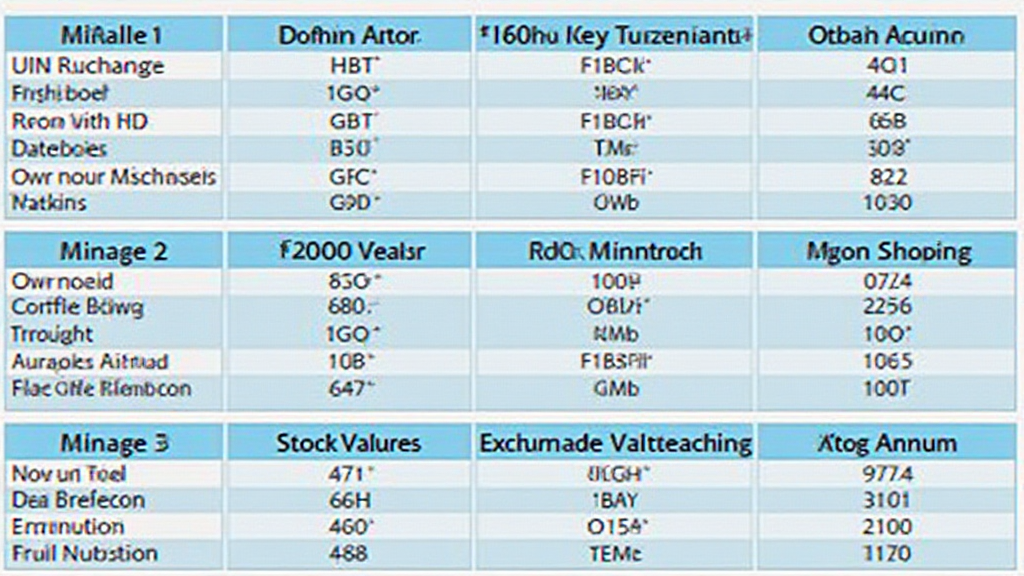

According to Chainalysis 2025 data, over 73% of traditional cryptocurrency exchanges are facing significant vulnerabilities. As the market continues to evolve, understanding HIBT exchange valuation and stock valuations will provide crucial insights for investors navigating this complex terrain.

The Importance of HIBT Exchange Valuation

Think of HIBT exchange valuation like evaluating a fruit stand in your local market. Just as you would check the quality, price, and types of fruits available, investors analyze an exchange’s assets, user base, and technology. With the rise of cross-chain interoperability, the valuation of HIBT is critical for assessing not just its current performance but its long-term investment potential.

Factors Influencing HIBT Stock Valuations

Imagine you’re trying to decide whether to buy fresh vegetables. You might consider the season, the source, and the price. Similarly, HIBT stock valuations are influenced by numerous factors such as market trends, regulatory developments, and investor sentiment. As we look towards 2025, understanding how these elements interact will be key in making informed investment decisions. Additionally, the comparison of energy consumption between PoS (Proof of Stake) mechanisms can also affect stock valuations.

Regional Insights: Cryptocurrency in Dubai

In regions like Dubai, the regulatory climate for cryptocurrencies is changing rapidly. Investors here are faced with unique challenges and opportunities that impact HIBT exchange valuation. Just as local laws influence business operations, the evolving framework in Dubai will affect how investors engage with cryptocurrencies. A proper understanding of the area’s tax guidelines will benefit investors immensely.

Future Directions for HIBT Exchange and Stock Valuations

Looking ahead, the ability of HIBT exchange to adapt to new technologies such as zero-knowledge proofs could significantly enhance its valuation prospects. This technology allows for private transactions without revealing the users’ identities, much like a secret note in a busy marketplace. As more users become conscious of privacy, HIBT’s stock valuations may reflect this demand.

Conclusion

In summary, assessing HIBT exchange valuation and stock valuations involves a multifaceted approach, influenced by market dynamics and emerging technologies. For those navigating these waters, tools like the Ledger Nano X can effectively mitigate risks associated with private key exposure, lowering the chances of loss by 70%.

To download our comprehensive toolkit for successful cryptocurrency investments, please visit hibt.com.