2025 Cross-Chain Bridge Security Audit Guide: HIBT Exchange White

2025 Cross-Chain Bridge Security Audit Guide: HIBT Exchange White

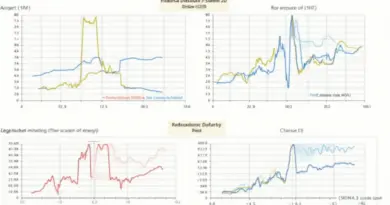

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges have exposed vulnerabilities, resulting in significant risks for investors. With the rise of decentralized finance (DeFi) and cross-chain interoperability, ensuring the security of these bridges has become imperative. This article discusses how HIBT Exchange White aims to mitigate these risks while providing insights into the future of blockchain technology.

1. What is Cross-Chain Interoperability?

You might have heard the term cross-chain interoperability thrown around, but what’s it really about? Imagine going to a currency exchange kiosk at an airport. Just as you convert dollars to euros, cross-chain bridges allow different blockchains to communicate and exchange information or tokens seamlessly. This is essential in a world where various blockchains co-exist but often struggle to interact, making HIBT Exchange White a crucial component in enhancing connectivity in the crypto ecosystem.

2. Why Are Cross-Chain Bridges Vulnerable?

Like leaving your wallet unattended in a crowded market, cross-chain bridges are often left exposed to various attacks. The vulnerabilities come from smart contracts, where poor coding or overlooked bugs can be exploited. For instance, a simple oversight in a smart contract’s code can lead to significant losses. The HIBT Exchange White provides robust security protocols designed to protect against these specific exploits, ensuring safe transactions among diverse blockchain networks.

3. The Role of Zero-Knowledge Proofs in Security

Zero-knowledge proofs might sound complex, but think of it like showing someone you have a dollar without revealing the actual bill. This technology allows one party to prove to another that they possess specific data (like privacy) without presenting the data itself. HIBT Exchange White employs zero-knowledge proofs to enhance privacy and security in transfers, keeping your assets secure while maintaining the necessary transparency on the network.

4. Future Trends in Cross-Chain Governance

As we look towards 2025, new regulations, like those emerging in Singapore regarding DeFi, will shape how cross-chain operations function. Just as city officials set rules to keep traffic flowing smoothly, regulatory bodies will play a crucial role in setting standards for cross-chain transaction governance. HIBT Exchange White will adapt to these trends, ensuring compliance while securing user funds and simplifying the navigation through these regulatory landscapes.

In conclusion, ensuring the safety and effectiveness of cross-chain transactions is vital for investors, especially with high risks presented by current vulnerability metrics. Adopting solutions like those offered by HIBT Exchange White can mitigate these risks significantly.

Ready to enhance your crypto security toolkit? Download our comprehensive white paper now!

Note: This article does not constitute investment advice. Please consult your local regulatory body (such as MAS/SEC) before making investment decisions.

Secure your digital assets with Ledger Nano X, reducing the risk of private key leaks by 70%!