2025 HIBT Fee Reduction Strategies in Stock Trading

2025 HIBT Fee Reduction Strategies in Stock Trading

According to Chainalysis, 73% of global cross-chain bridges faced vulnerabilities in 2025, potentially leading to substantial fees and losses in stock trading. In this rapidly evolving financial landscape, understanding HIBT fee reduction strategies and stock cost-reduction strategies has never been more crucial.

Why Understand HIBT Fee Reduction Strategies?

Imagine trying to send money across different currencies without a proper exchange rate. HIBT fee reduction strategies can minimize the costs associated with trading multiple stocks in varying currencies. By optimizing these strategies, you can save substantially on trading fees, ensuring that more of your investments go toward building your portfolio rather than being eaten up by fees.

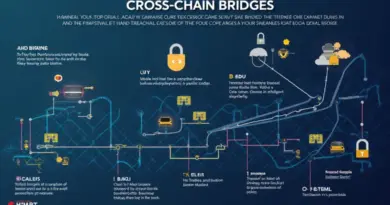

The Role of Cross-Chain Interoperability

Cross-chain interoperability is like having a universal remote control for all your devices. In stock trading, it allows seamless transactions across multiple platforms. By utilizing fee reduction strategies embedded in these technologies, traders can reduce transaction costs significantly, making it a win-win for everyone. For instance, traders participating in decentralized finance can leverage liquidity pools that minimize slippage and transaction costs, offering an effective cost-reduction strategy.

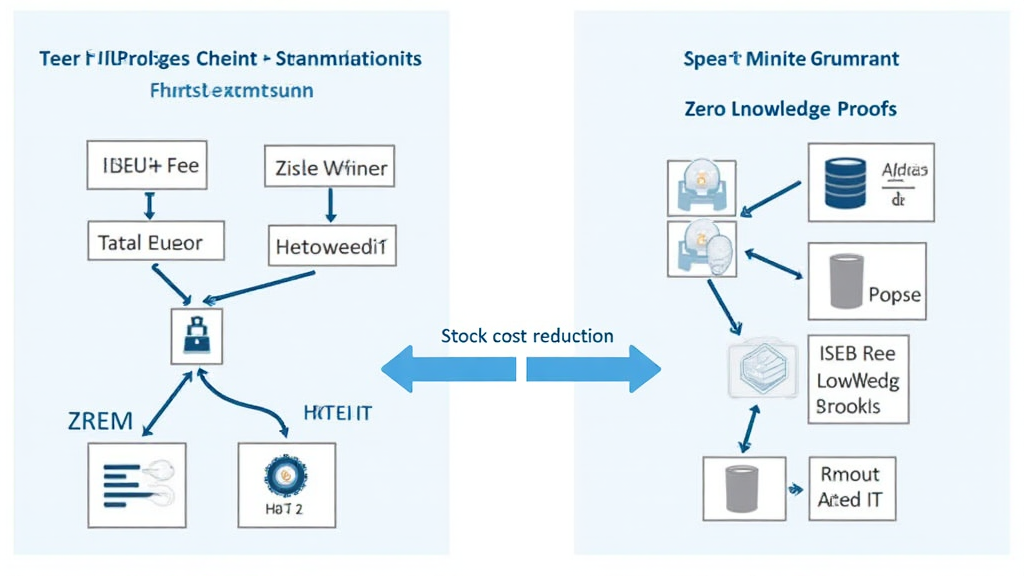

Adopting Zero-Knowledge Proof Applications

Ever tried buying produce at a market without letting the vendor know your budget? That’s what zero-knowledge proofs do in the crypto world—they verify transactions without revealing unnecessary data. By applying this technology, investors can partake in stock trading while keeping costs low and maintaining their privacy, thus effectively employing HIBT fee reduction strategies.

Comparative Analysis of Minimizing PoS Mechanism Energy Consumption

Let’s break it down like cooking: choosing the right stove can save you both energy and time. In the world of Proof of Stake (PoS) mechanisms, energy-efficient models not only speed up transactions but also keep costs down. Analyzing various PoS mechanisms shows that selecting a more energy-efficient option can help lower operational costs significantly.

In conclusion, it’s crucial to consider the implementation of HIBT fee reduction strategies and stock cost-reduction strategies in your trading approach. To take your trading to the next level, be sure to explore our downloadable toolkit for practical tips and insights. Download our comprehensive trading toolkit today!