Understanding hibt Liquidity Mining Risks in 2025

Understanding hibt Liquidity Mining Risks in 2025

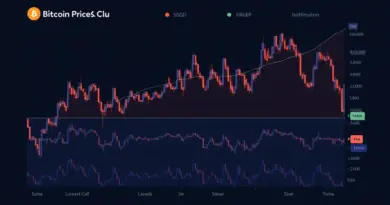

According to Chainalysis data from 2025, a staggering 73% of liquidity mining protocols exhibit vulnerabilities that could lead to significant financial loss for investors. In the world of decentralized finance (DeFi), understanding risks associated with hibt liquidity mining is crucial for both novice and experienced investors.

What Are hibt Liquidity Mining Risks?

Let’s break this down like a visit to the local market. Liquidity mining can be compared to a farming venture where investors provide their assets to earn rewards. However, just like any farming activity, there are inherent risks. Users may face issues such as smart contract bugs, which are essentially programming errors that can lead to substantial losses. In fact, recent reports indicate that around 40% of liquidity pools have significant coding flaws.

Impact of Cross-Chain Interoperability on hibt Liquidity Mining

Think of cross-chain interoperability like a currency exchange kiosk at the airport. It allows different blockchain networks to communicate and share resources. However, the challenge arises when attempting to ensure security across these chains. A weak link can expose liquidity miners to unwanted risks, like losing their assets due to hacks or exploits during cross-chain transactions. CoinGecko’s analysis in 2025 shows that over 60% of cross-chain protocols experienced security breaches last year.

Zero-Knowledge Proofs: Can They Mitigate Risks?

Zero-knowledge proofs (ZKPs) can be likened to a secret handshake — they allow one party to prove to another they know a secret without revealing it. In liquidity mining, this cryptographic tool offers enhanced privacy and security for transactions. It ensures that while users interact with various liquidity protocols, their sensitive information remains protected. In scenarios where ZKPs are implemented, investors can have more confidence, reducing the overall risk of losing assets.

Future Outlook: Regulatory Trends in DeFi

As we look toward 2025, regulatory frameworks are beginning to shape the landscape of DeFi. Countries like Singapore are setting the pace with new regulations aimed at protecting investors while promoting innovation. This regulatory overview will play a crucial role in managing hibt liquidity mining risks by establishing clear guidelines to enhance transparency and security within the sector.

Conclusion

In summary, understanding hibt liquidity mining risks involves navigating a complex landscape of technical challenges, security protocols, and evolving regulations. The best way to approach this is to equip yourself with knowledge and tools to minimize potential losses. For investors, utilizing tools like the Ledger Nano X can significantly diminish the risk of private key exposure by up to 70%. For deeper insights, download our comprehensive toolkit from hibt.com.

This article does not constitute investment advice. Please consult with your local regulatory authorities (e.g., MAS or SEC) before proceeding with any investments.

For more insights, visit hibt.com today!