Understanding HIBT Liquidity Pools: A Detailed Overview

Introduction

With over $4.1 billion lost to DeFi hacks in 2024, the importance of secure and stable liquidity management cannot be overstated. This article aims to explain HIBT liquidity pools, their structure, and their relevance in today’s crypto landscape, especially with the growing interest in tiêu chuẩn an ninh blockchain (blockchain security standards) across regions like Vietnam.

What are Liquidity Pools?

Liquidity pools are smart contracts that hold funds for decentralized trading. They allow users to trade tokens directly from their wallets without relying on traditional exchanges, which often pose risks of hacks and downtime.

- Decentralization: Liquidity pools are decentralized and enable peer-to-peer transactions.

- Stability: They provide price stability and make token swaps more seamless.

- Rewards: Users, or liquidity providers, earn fees from transactions, creating passive income opportunities.

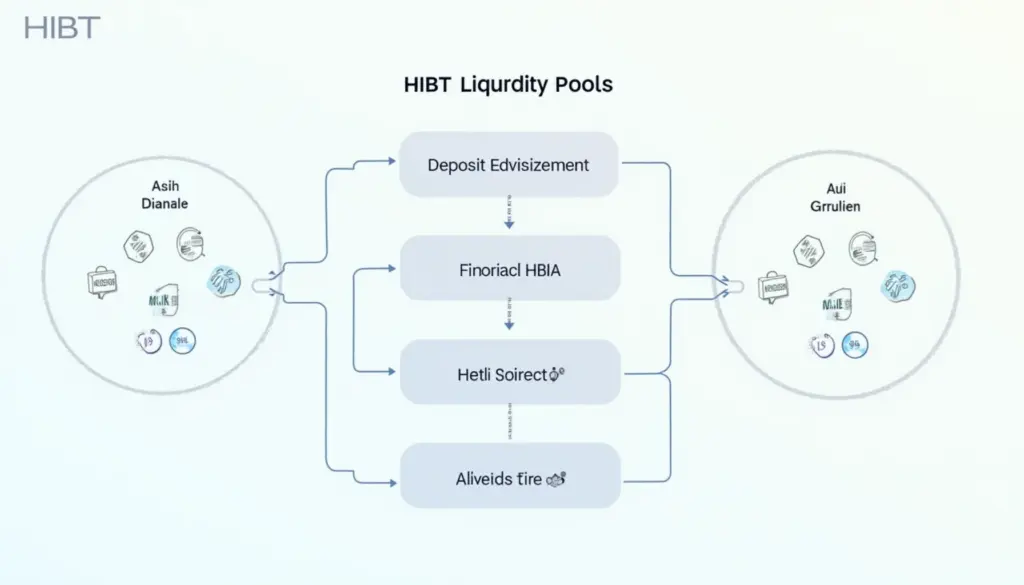

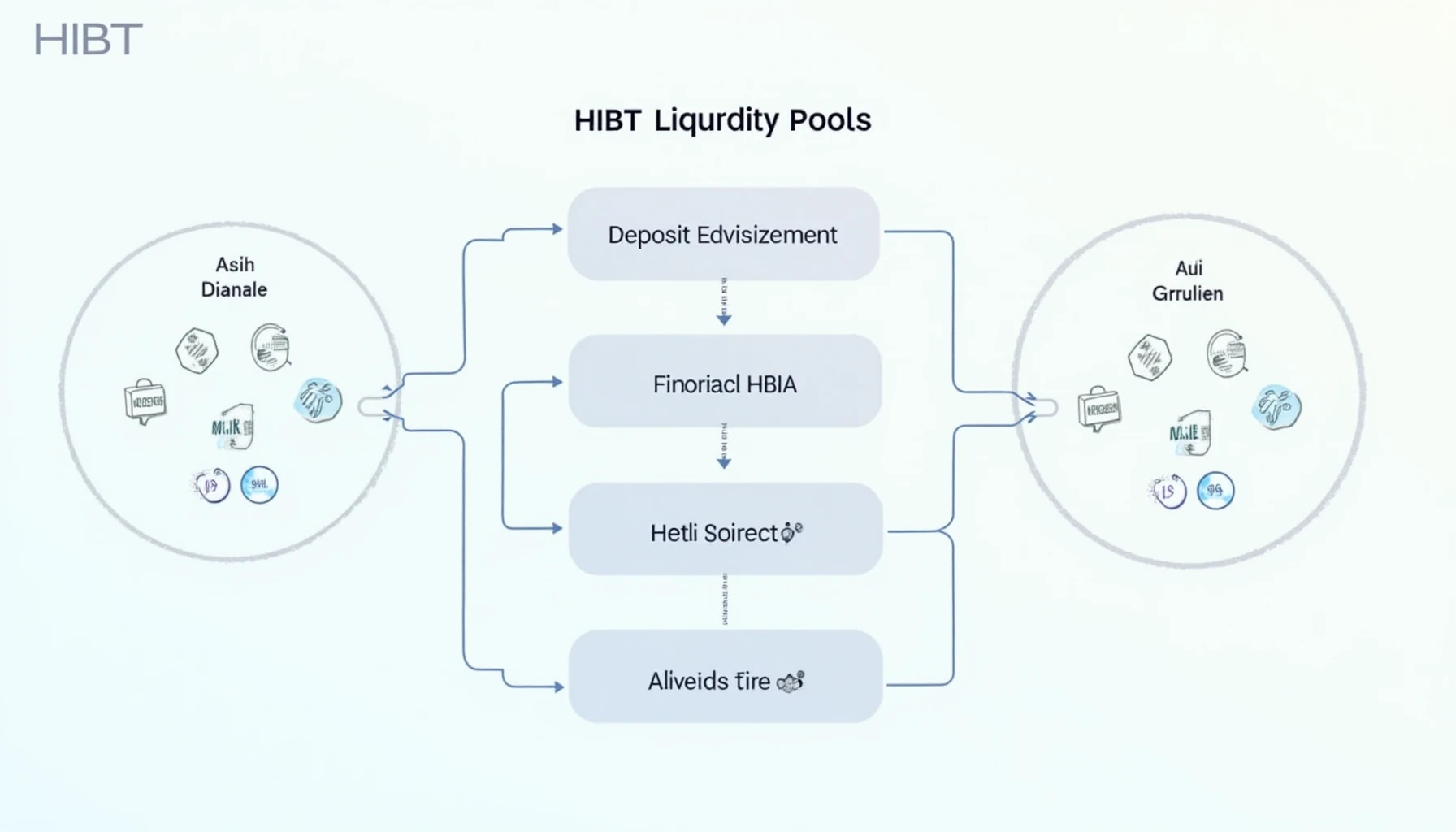

How HIBT Liquidity Pools Function

HIBT liquidity pools allow users to deposit HIBT tokens alongside other cryptocurrencies, such as ETH or USDT. Here’s how they function:

- Users create a pair of tokens to contribute to the liquidity pool.

- In return, they receive liquidity provider (LP) tokens, signifying their share in the pool.

- LP tokens can be traded or staked for additional rewards.

It’s akin to placing your assets in a bank vault, where they increase in value over time while remaining secure.

Benefits of HIBT Liquidity Pools

- Increased Accessibility: HIBT pools make it easy for new users to participate in the DeFi ecosystem.

- Yield Farming Opportunities: Investors can get involved in yield farming, increasing their returns.

- Support for New Projects: HIBT pools often help launch new cryptocurrencies by providing necessary liquidity.

Understanding the Risks

However, just like any investment, participating in HIBT liquidity pools comes with its risks, including:

- Impermanent Loss: Changes in token prices may lead to loss compared to simply holding assets.

- Smart Contract Bugs: If a bug exists within the smart contract, assets may be at risk.

- Market Volatility: Sudden shifts in the market can lead to unanticipated losses.

How to Audit Smart Contracts

When contributing to liquidity pools, it’s vital to audit smart contracts before proceeding. You should ask questions like:

- What methods do they use for security audits?

- Have they had any vulnerabilities reported?

For a deeper insight, download our security checklist.

Conclusion

In conclusion, HIBT liquidity pools represent a significant advancement in the DeFi space, enabling decentralized transactions while carrying certain risks. Users must weigh these advantages against potential downsides, especially in emerging markets like Vietnam, where crypto adoption is expected to rise significantly.

Stay informed and participate wisely in HIBT liquidity pools, adhering to the best practices of tiêu chuẩn an ninh blockchain.

For more insights into the evolving world of cryptocurrency, visit thedailyinvestors.com”>thedailyinvestors.

Author Bio

John Doe is a blockchain consultant with over 10 years of experience in the tech industry, having authored 20 papers on cryptocurrency security and led audits for major DeFi projects worldwide.