A Comprehensive Guide to HIBT Liquidity Staking Explained

Understanding HIBT Liquidity Staking Explained

In 2025, Chainalysis reported that 73% of decentralized finance (DeFi) platforms still lack robust security measures. With the ever-growing DeFi landscape, understanding liquidity staking is crucial for investors looking to mitigate risks. In this article, we break down HIBT liquidity staking explained, providing insights into its mechanics and benefits.

What is Liquidity Staking?

Imagine a bustling market where people go to exchange their goods. Liquidity staking is like providing your products to that market, allowing buyers and traders to have what they need. Simply put, when you stake cryptocurrencies in a liquidity pool, you help facilitate trades and earn rewards in return. This is the foundation of DeFi networks and how many users make profit.

Why is HIBT Important for DeFi?

In the DeFi ecosystem, HIBT provides much-needed liquidity akin to a fuel that keeps a vehicle running. Without liquidity, platforms would struggle to facilitate transactions efficiently. A strong liquidity staking model like HIBT also supports cross-chain interoperability—this is like having highways between different cities, enabling faster transportation of goods.

How Does Liquidity Staking Work?

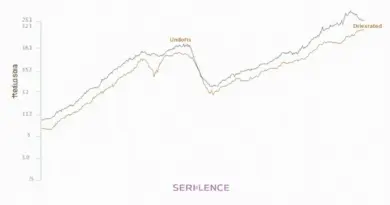

Think of liquidity staking as a savings account, but instead of earning interest, you earn tokens. By locking your cryptocurrencies in a liquidity pool, you allow others to trade with them. In return, you receive a share of the transaction fees or new tokens. Just as a bank invests your money to grow its wealth, liquidity protocols use your staked funds to enhance their services, offering users a win-win scenario.

Regulatory Considerations in Different Regions

With the changing landscape of DeFi regulations, it’s essential for investors to stay updated. For example, the upcoming regulations in Singapore are expected to shape how liquidity staking operates in the region. It’s prudent to consult local regulatory bodies (like MAS) to ensure compliance—this is similar to checking local laws before starting a business.

In conclusion, understanding HIBT liquidity staking explained not only helps in making informed investment decisions but also empowers users to navigate the DeFi space effectively. Are you interested in deepening your knowledge? Download our comprehensive toolkit today!

For more in-depth analysis, check out our white paper on liquidity protocols and frequently asked questions.

**Risk Disclosure:** This content does not constitute investment advice. Consult your local regulatory authority before making investment decisions. Use a secure wallet like Ledger Nano X to protect your digital assets.