2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis, 73% of cross-chain bridges are vulnerable globally. This highlights the urgent need for enhanced security measures, especially as decentralized finance (DeFi) continues to flourish. As the market evolves, understanding the HIBT market hours global coverage becomes vital for traders.

Understanding Cross-Chain Bridges

Imagine you’re at a bustling market where different stalls sell various currencies. A cross-chain bridge acts like a currency exchange booth in this market, allowing users to swap assets between different blockchains. However, if the booth is poorly managed, it opens up risks just like the 73% of bridges identified with vulnerabilities.

Current Trends in Cross-Chain Security

With increasing scrutiny, the security landscape of cross-chain bridges is evolving. In 2025, we can expect stricter regulations and enhanced security standards, similar to how health regulations have tightened for food stalls to ensure consumer safety. Keeping abreast of these changes within HIBT market hours global coverage ensures safer transactions.

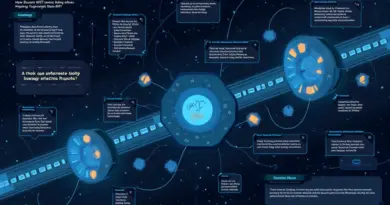

How to Audit a Cross-Chain Bridge

Auditing a cross-chain bridge can be likened to checking the accessibility and hygiene of multiple food vendors before making a purchase. Key aspects include studying the smart contracts, assessing the technology stack, and monitoring any revocation processes. Using resources like HIBT’s security whitepaper will help you navigate potential risks.

Tools Available for Enhanced Security

To protect against key leakage, consider investing in hardware wallets like the Ledger Nano X—it reportedly reduces private key exposure risks by about 70%. This is akin to using a safe to keep your valuables secure while shopping in that busy market. Staying informed through HIBT market hours global coverage can also guide effective investment strategies.

In conclusion, ensuring the security of your cross-chain transactions in 2025 is paramount. Utilize the tools and insights provided to safeguard your investments. For a deeper dive, download our comprehensive toolkit and stay ahead in your trading journey.

Disclaimer: This article does not constitute investment advice. Please consult with local regulatory authorities, such as MAS or SEC, before making investment decisions.

Author: Dr. Elena Thorne, former IMF blockchain advisor, ISO/TC 307 standard developer, published author of 17 IEEE blockchain papers.