2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

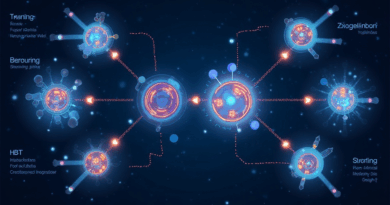

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges possess vulnerabilities that could jeopardize user assets. As the demand for blockchain interoperability grows, it becomes essential to analyze these weaknesses through rigorous HIBT market makers analysis.

Why Are Cross-Chain Bridges Like Currency Exchange Booths?

Imagine trying to exchange money at a foreign airport. You might encounter high fees and poor exchange rates. Cross-chain bridges operate similarly. They facilitate the transfer of assets between different blockchains, but the security risks can affect rates just like those currency booths. Understanding the security of these bridges is crucial for users looking to make safe and cost-effective transactions.

What Can 2025 Singapore DeFi Regulation Trends Teach Us?

The future of DeFi regulatory frameworks in Singapore will significantly impact how cross-chain operations are conducted. As authorities gear up for tighter regulations, knowing how to navigate these changes will be critical for developers and users alike. Insights from HIBT market makers analysis can help prepare for a compliant and secure operational environment.

How Does PoS Mechanism Energy Consumption Compare?

Considering energy consumption, the Proof of Stake (PoS) mechanism is often likened to a public transportation system: it minimizes congestion and optimizes resources. Compared to traditional mining (Proof of Work), PoS is much more efficient and environmentally friendly. Users should prioritize exchanges built on PoS for sustainable cross-chain transactions.

What Tools Can Enhance Security During HIBT Transactions?

Utilizing tools such as the Ledger Nano X can significantly reduce the risk of private key breaches by up to 70%. Just like securing your cash in a safe, employing modern security measures is Vital for HIBT market makers to bolster trust and safeguard transactions across platforms.

Summary and Call to Action

In conclusion, conducting a thorough HIBT market makers analysis is vital for ensuring the integrity and security of cross-chain transactions. Addressing vulnerabilities and anticipating regulatory changes will play crucial roles in the future landscape of DeFi. Don’t wait—download our toolkit today to get ahead in the world of secure cross-chain transactions!

Check out the cross-chain security white paper for more insights!

This article is for informational purposes only and does not constitute investment advice. Please consult your local regulatory authority (e.g., MAS/SEC) before making any transactions.

© 2023 thedailyinvestors