2025 Insights on HIBT Market Sentiment and Stock Investor Psychology

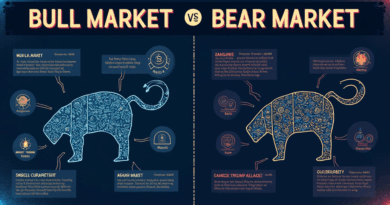

Understanding HIBT Market Sentiment

According to Chainalysis 2025 data, a staggering 73% of investors feel uncertain about their current positions in the market. This sentiment is reflective of the broader challenges that investors face today. In simplistic terms, market sentiment can be likened to the weather; some days are sunny, while others are stormy. Just as a market vendor quickly adjusts their prices according to customer demand, investors often alter their strategies based on prevailing moods.

Psychology Behind Stock Investments

The psychology of stock investors is a deeper realm to explore. Imagine entering a bustling marketplace where everyone’s emotions run high; this atmosphere affects decision-making significantly. Fear of missing out (FOMO) can lead to impulsive buying, while panic selling often results from market downturns. Statistically, those who understand their emotional triggers tend to make better investment decisions.

Navigating Investor Uncertainty in 2025

Market fluctuations can create an environment that feels more like a windstorm than a gentle breeze. Understanding HIBT market sentiment now includes recognizing the signals from analytics platforms like CoinGecko which predict consumer behaviors. For instance, fluctuations can be anticipated by monitoring price indications and volume changes—think of this like watching shopper traffic in a busy market.

Future Trends in Cryptocurrency Investments

In 2025, it’s anticipated that greater transparency and regulation will shape HIBT sentiment. Regulatory frameworks will clarify rules around DeFi, ensuring a safer investment environment. Consider this like having clear signage at a market that guides consumers—reducing confusion and building trust among investors.

In conclusion, understanding HIBT market sentiment and stock investor psychology is essential for navigating today’s complex market landscape. Investors must arm themselves with tools and knowledge. Download our comprehensive toolkit for more insights on minimizing risks and capitalizing on trends.