2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges exhibit vulnerabilities that could jeopardize user assets. In the evolving landscape of decentralized finance (DeFi), understanding these weaknesses is crucial for investors aiming to safeguard their digital properties.

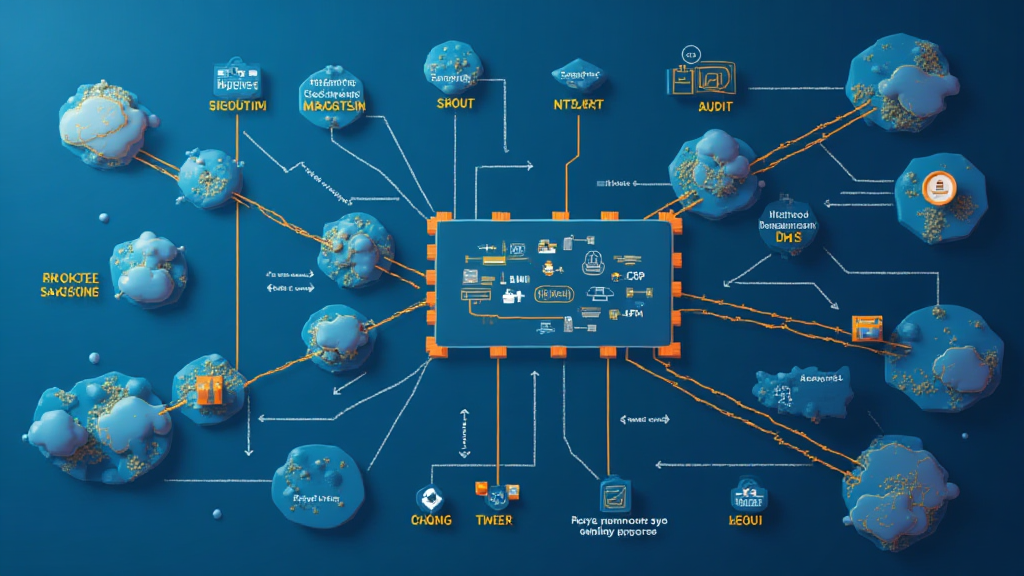

What is a Cross-Chain Bridge?

To put it simply, a cross-chain bridge functions like a currency exchange booth at an airport. Just as you would exchange dollars for euros, a cross-chain bridge allows assets to move from one blockchain to another. This functionality is essential for the increasing demand for interconnected blockchains.

Why Are Vulnerabilities a Concern?

Vulnerabilities in these bridges can open doors for malicious actors. For example, in 2024, hackers exploited weaknesses in major cross-chain protocols, resulting in losses exceeding $1 billion. As investors, understanding potential risks associated with these platforms is vital for making informed decisions.

Evaluating the Security of Cross-Chain Bridges

Investors should approach cross-chain bridges with a risk assessment mindset. Think of it like checking the security features of a bank before depositing your money. Tools like code audits and security certifications can provide insight into a bridge’s reliability.

The Role of Smart Contracts in Enhancing Security

Utilizing smart contracts is one way to bolster the security of bridges. It’s like implementing a padlock on your cash register. These contracts can automate processes and enforce rules, reducing human error and the likelihood of vulnerabilities.

In summary, as the DeFi space continues to grow, understanding the mechanics of cross-chain bridges becomes increasingly important. Download the HIBT media kit availability to get essential tools for assessing security and protecting your investments.

Download the complete cross-chain security whitepaper here.

Note: This article is not intended as investment advice. Always consult with local regulatory entities, such as the MAS or SEC, before taking any action. Consider using the Ledger Nano X to reduce the risk of private key exposure by 70%.

Written by:

【Dr. Elena Thorne】

Former IMF Blockchain Advisor | ISO/TC 307 Standard Creator | Author of 17 IEEE Blockchain Papers