2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges are found to have vulnerabilities. With such alarming figures, it’s crucial to stay informed about the latest developments in blockchain security, especially when it involves cross-chain interoperability.

What is Cross-Chain Interoperability?

Think of cross-chain interoperability like the money exchange booths you find at airports. Just like those booths facilitate transactions between different currencies, cross-chain technology enables the transfer of tokens across various blockchains. But just as some booths might charge outrageous fees, the security of these technologies varies significantly.

Common Vulnerabilities in Cross-Chain Bridges

You might have heard of hackers exploiting weaknesses in certain bridges to siphon off millions. These vulnerabilities often arise from inadequate security measures or outdated protocols. For instance, some bridges do not adequately implement zero-knowledge proofs, leaving them exposed to attacks.

The Cost of Security Breaches

In the same way that a stolen wallet can cost you dearly, security breaches in the crypto world can have catastrophic financial repercussions. Research indicates that the average cost of security incidents in 2025 could exceed $1 million per incident. This highlights the pressing need for robust security protocols.

Staying Ahead of the Curve

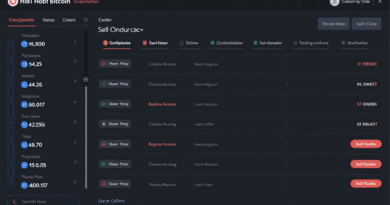

To mitigate risks, it’s essential to keep abreast of trends and security reviews. Utilizing reputable applications like the HIBT mobile app not only helps keep your assets secure but can also provide insights into the latest regulatory environment, especially concerning jurisdictions like the Dubai cryptocurrency tax guide.

In conclusion, the landscape of cross-chain bridges is fraught with potential dangers, but by arming yourself with knowledge and tools, you can traverse this world more safely. Don’t forget to download the HIBT mobile app to stay informed and secure your Bitcoin assets.

Check out the cross-chain security whitepaper for in-depth insights and recommendations. Remember, it’s always wise to consult local regulatory agencies before making investment decisions.

This content is created as a guide and does not constitute investment advice. Consult your local regulatory body such as MAS or SEC before engagement in any transactions. Tools like the Ledger Nano X can reduce the risk of private key exposure by up to 70%.