Mastering HIBT Options Spread Strategies

Introduction

In 2024, over $4 billion was lost to hacks related to decentralized finance (DeFi) platforms. As a trader navigating this volatile landscape, understanding effective strategies is crucial. HIBT options spread strategies can offer a structured way to minimize risk while maximizing potential returns in the crypto market.

What are HIBT Options?

HIBT (High-Intensity Binary Trading) options are unique derivatives that allow traders to speculate on price movements in cryptocurrencies. They provide the flexibility of designing strategies that can hedge risk during market fluctuations. For example, using a staggered approach can be likened to building multiple security layers around a central vault.

Why Spread Strategies Matter

Utilizing options spread strategies enables traders to limit their risk exposure significantly. Here’s why this matters:

- Risk Management: By spreading your options, you can mitigate potential losses.

- Maximized Gains: Spreads can potentially increase profitability during favorable market conditions.

- Market Volatility: They provide flexibility to navigate unpredictable market swings.

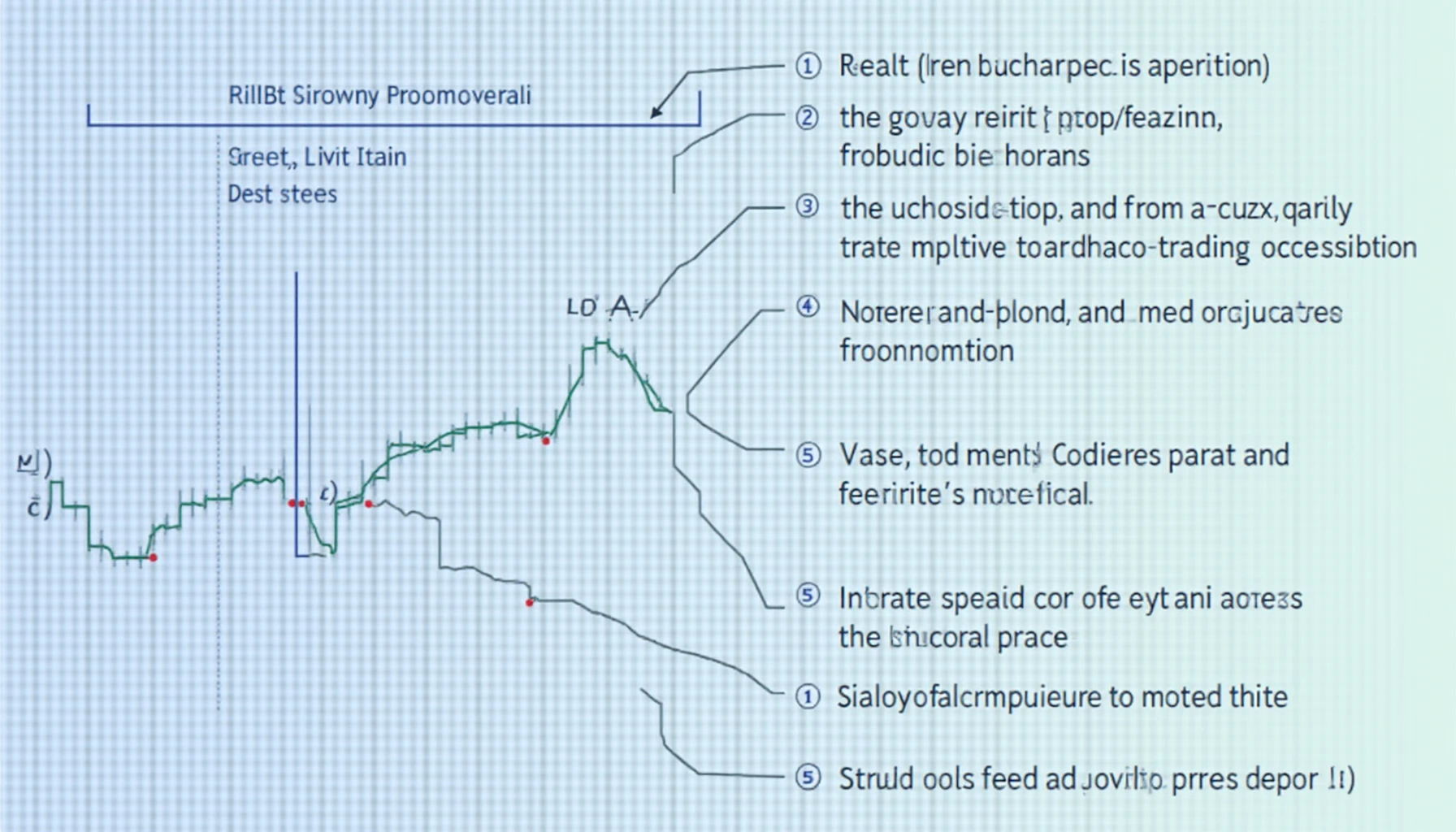

Types of HIBT Options Spread Strategies

There are several HIBT options spread strategies to consider:

1. Bull Spread

This approach is ideal when you anticipate a moderate increase in cryptocurrency prices. For instance, if you believe Bitcoin will rise marginally, you can buy an option at a lower strike price and sell an option at a higher strike price.

2. Bear Spread

If you’re expecting a decline, a bear spread allows you to benefit from falling prices. You sell an option with a higher strike price while buying one with a lower strike price.

3. Iron Condor

This strategy involves using both call and put options to profit from low volatility in the market. It’s akin to setting multiple warning alarms around your digital assets.

Case Study: Adoption in Vietnam

With a 23% annual increase in cryptocurrency users in Vietnam, understanding and adopting these strategies locally is essential. Consider this local data:

| Year | Crypto Users |

|---|---|

| 2023 | 5 million |

| 2024 | 6.15 million |

As Vietnam’s crypto community grows, more traders are seeking effective HIBT options spread strategies to optimize their portfolios.

Conclusion

Mastering HIBT options spread strategies is pivotal for traders looking to navigate the complex world of cryptocurrency. They provide not only a hedge against risks but also a method to capitalize on market opportunities. The increasing number of Vietnamese cryptocurrency users indicates a solid growth trajectory in this sector. Start experimenting with these strategies today and stay ahead in the crypto game!

For more insights, check out HIBT’s resources.