Understanding HIBT Options Trading Volume: A Key to Cryptocurrency Success

Introduction: What You Need to Know About HIBT Options Trading Volume

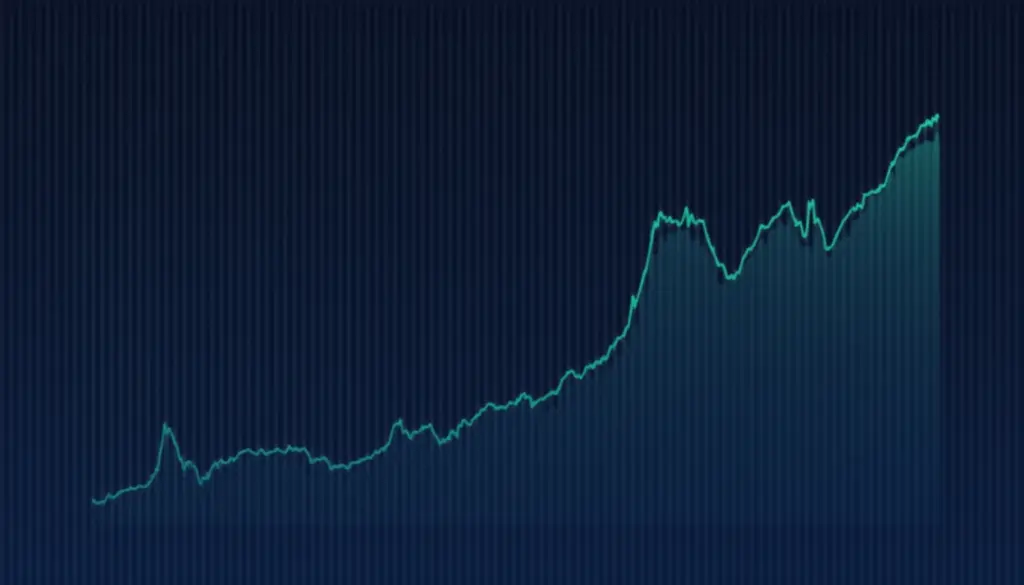

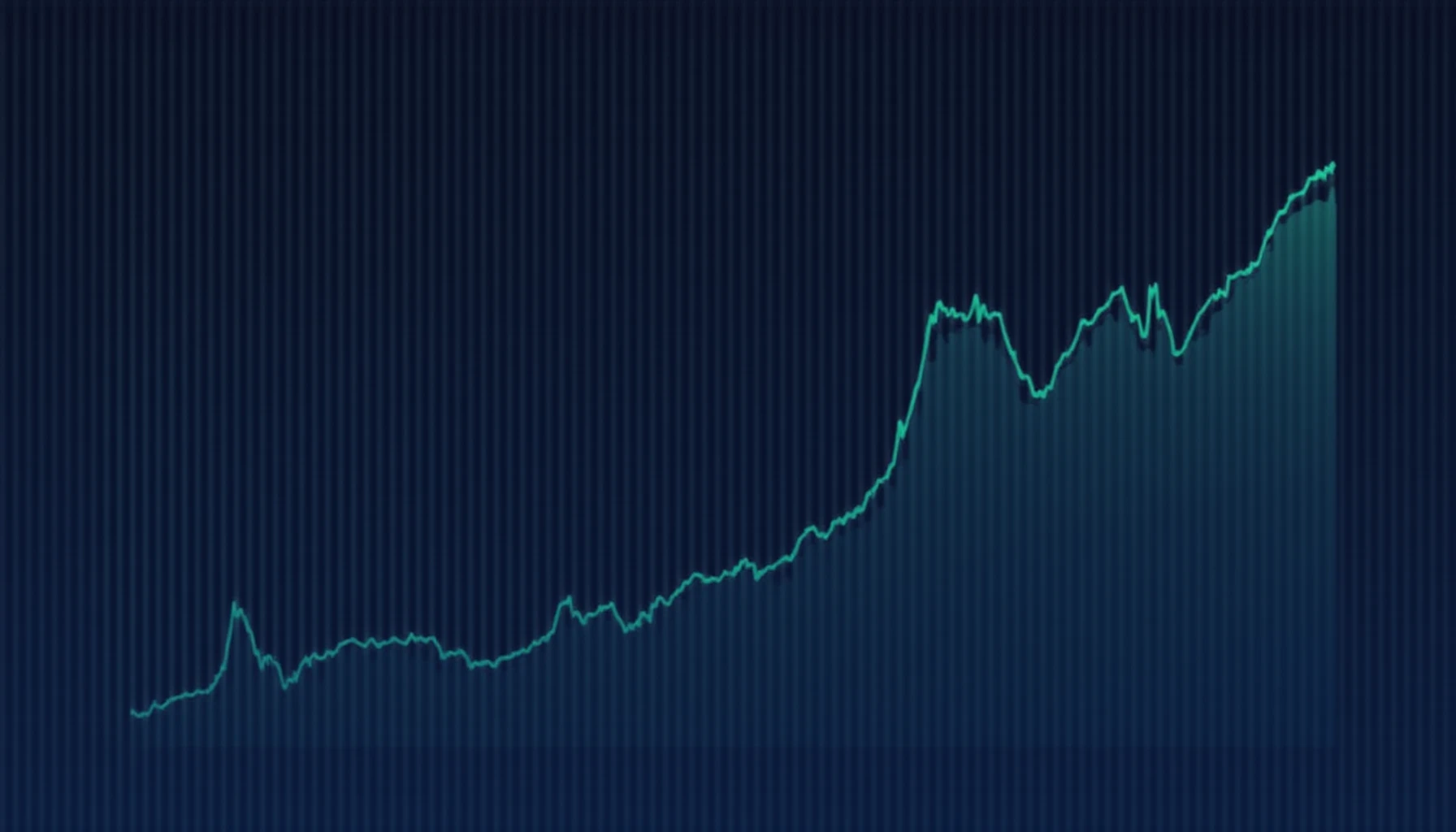

Did you know that cryptocurrency trading volumes can significantly impact market dynamics? According to recent reports, the trading volume of HIBT options has surged by over 50% this year, reflecting growing interest in decentralized finance. Understanding HIBT options trading volume is crucial for both novice and experienced investors looking to navigate the complexities of digital currency trading.

The Basics of HIBT and Its Trading Volume

When discussing HIBT, we’re referring to the unique trading options that allow investors to leverage their positions in the market. The trading volume of HIBT options indicates the number of contracts traded within a specific period. A high trading volume is often seen as a healthy indicator of market interest and liquidity.

- What is HIBT? A brief overview

- The relationship between trading volume and price volatility

- What does it mean for investors?

How HIBT Trading Volume Affects Market Trends

In the world of cryptocurrency, trading volumes can dictate trends. For example, a spike in the HIBT options trading volume may suggest that traders are anticipating price movements, leading to significant market shifts. Understanding these trends can help you make informed decisions about which assets to invest in.

Real-World Examples

Let’s break it down: imagine a local farmer’s market where various vendors are selling fresh produce. If one vendor suddenly sees a surge in customers, it indicates a growing demand for their product. Similarly, a rising HIBT trading volume can signal that more traders are interested in this particular option. This can help investors gauge potential price changes and strategies.

Best Practices for Trading HIBT Options

Are you looking to capitalize on HIBT options? Here are some best practices:

- Monitor market trends and volume regularly.

- Diversify your portfolio to mitigate risks.

- Utilize reliable tools for trading analysis, like trading bots and automated systems.

- Stay updated on regulatory changes in your region that may impact HIBT trading.

Conclusion: Take Charge of Your Trading Strategy Today

In summary, understanding HIBT options trading volume is essential for making educated trading decisions. With the right strategies and knowledge, you can harness the potential of HIBT options effectively. Ready to dive deeper? Check out our comprehensive guides on cryptocurrency trading and learn how to better manage your investments!

Disclaimer: This article does not constitute investment advice. Always consult with a local regulatory agency before making any financial decisions.