HIBT Order Book Analysis: Your Guide to Cryptocurrency Trading Strategies

Introduction: Understanding the Order Book

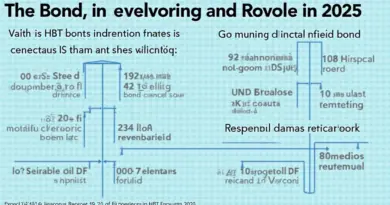

Did you know that over 5.6 billion people are involved in cryptocurrency trading globally, yet only 23% know how to analyze order books effectively? As digital currencies grow in popularity, understanding their trading mechanisms is crucial for success.

What is an Order Book?

An order book is a digital ledger used by cryptocurrency exchanges that lists all buy and sell orders in real-time. Imagine a bustling marketplace where vendors display their prices and buyers offer their bids — that’s akin to how an order book functions. The bids reflect the maximum price buyers are willing to pay, while the asks show the minimum price sellers will accept. By analyzing the order book, traders can gauge market sentiment and make informed decisions.

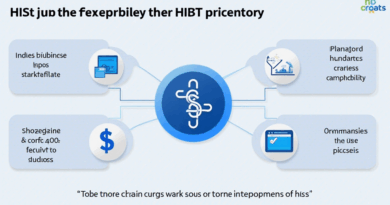

Benefits of HIBT Order Book Analysis

Using HIBT order book analysis can significantly enhance your trading strategies. Here are some key benefits:

- Market Sentiment: By monitoring real-time data, you can measure the buying or selling pressure in the market.

- Price Prediction: Identifying large buy or sell walls can help you predict price movements.

- Enhanced Trading Decisions: Make timely decisions based on the orders present, increasing your chances of successfully executing trades.

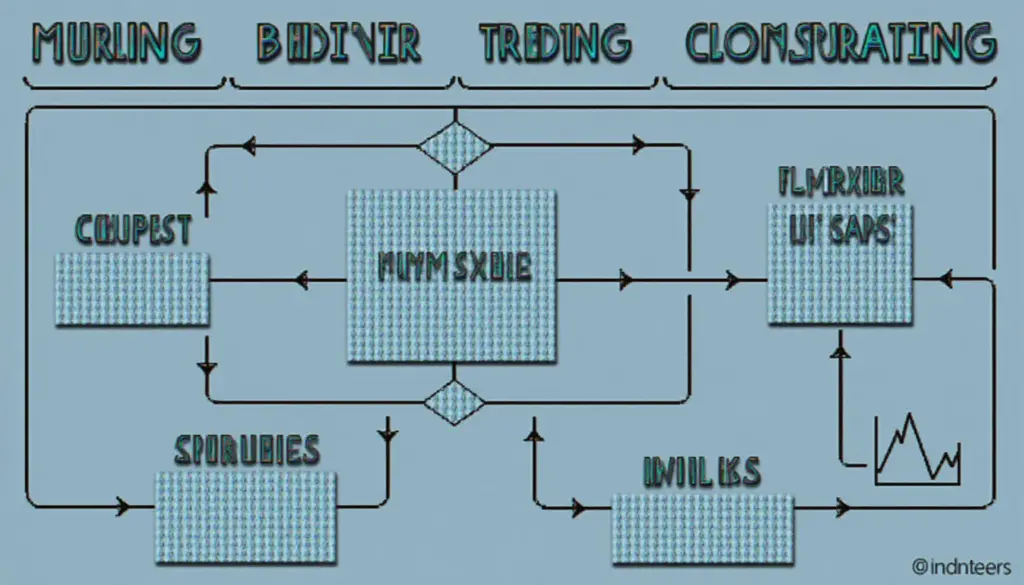

How to Perform HIBT Order Book Analysis

Performing order book analysis involves a few essential steps:

- Access the Order Book: Navigate to your chosen cryptocurrency exchange platform to view the order book.

- Identify Key Levels: Look for significant support and resistance levels indicated by large buy or sell orders.

- Analyze Volumes: Pay attention to volume size next to prices; larger volumes indicate stronger market interest.

- Monitor Changes: Regularly check for changes, adapting your strategy based on market fluctuations.

Common Mistakes to Avoid in Order Book Analysis

While order book analysis can be beneficial, avoid these common pitfalls:

- Ignoring Market Trends: Always consider the broader market context; ignore short-term fluctuations.

- Overtrading: Resist the temptation to trade impulsively based on order book signals alone.

- Neglecting Risk Management: Allocate your investments wisely; never invest more than you can afford to lose.

Conclusion: Empower Your Crypto Trading!

Understanding and utilizing HIBT order book analysis can provide you with a substantial edge in the crypto market. By having insight into market dynamics and making data-driven decisions, you can significantly enhance your trading performance. Remember, continual learning and adaptation are key components of successful trading. Ready to dive deeper?

Download our comprehensive guide on the safest ways to store cryptocurrency and maximize your investment potential!