HIBT Order Types Guide: Mastering Crypto Trading

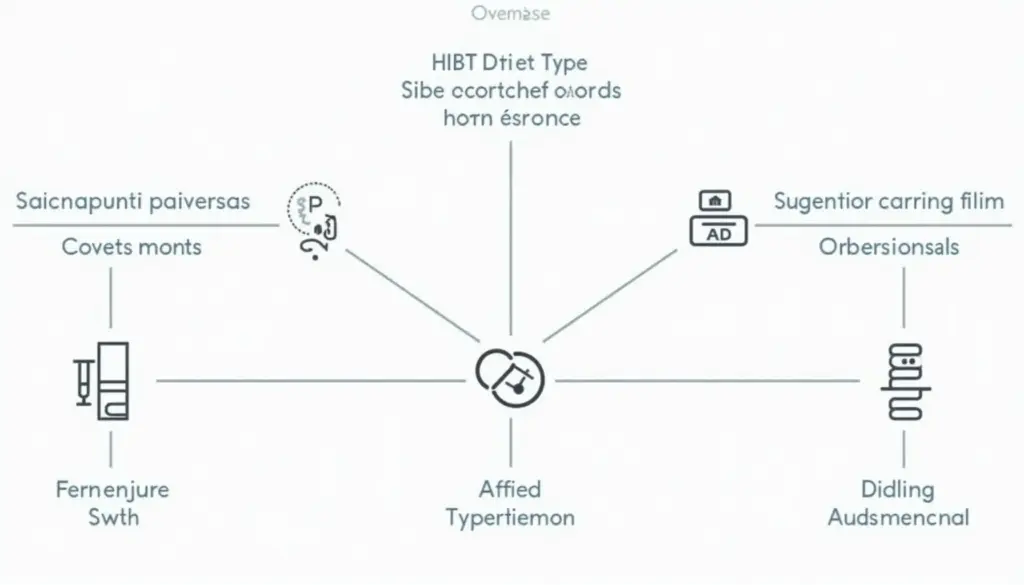

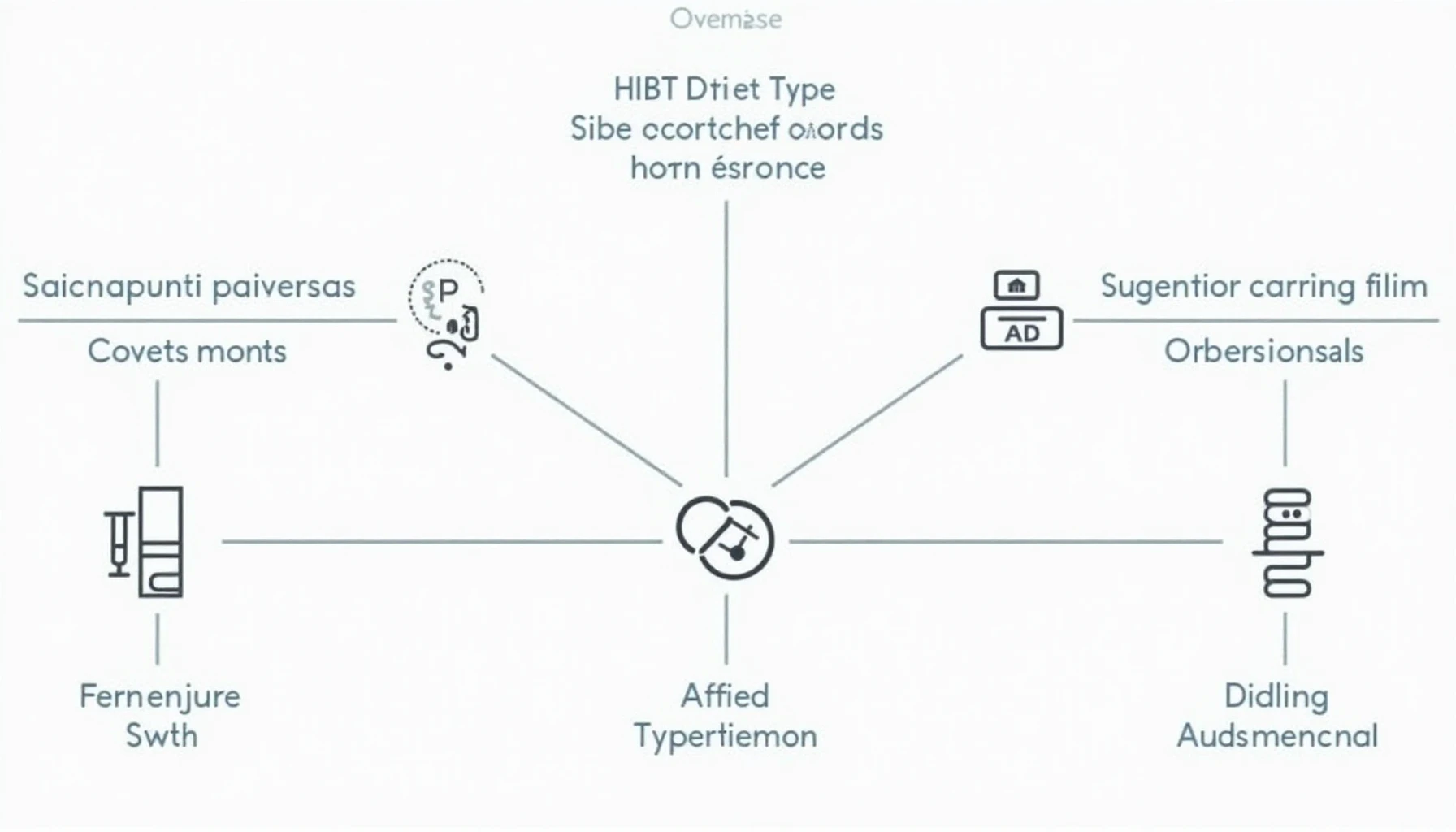

Introduction to HIBT Order Types

In the ever-evolving landscape of cryptocurrency, understanding the mechanics of trading is crucial. Did you know that 65% of crypto traders are concerned about market volatility? With $4.1B lost to trading mishaps in 2024, mastering HIBT order types may be your best defense against losses.

By implementing the right strategies, you can significantly bolster your trading performance. This guide will help you navigate through various order types on the HIBT platform, ensuring a smoother trading experience.

Understanding Basic Order Types

- Market Orders: These are executed immediately at the best available price. Ideal when speed is crucial.

- Limit Orders: You set a specific price to buy or sell. This allows for more control over executing trades.

- Stop-Loss Orders: Protects your investment by automatically selling once a certain price is reached.

Advanced Order Types in HIBT

Moving beyond basics, HIBT also offers sophisticated order types designed for a more nuanced trading strategy.

- Trailing Stop Orders: This automatically adjusts the stop-loss price as the market fluctuates in your favor.

- Fill or Kill Orders: Requires an immediate execution of the whole order or it gets canceled. Perfect for large trades.

Like the safety deposit box in a bank, these advanced orders help secure your investments while you navigate volatile markets.

Importance of Choosing the Right Order Type

| Order Type | Best Use Scenario |

|---|---|

| Market Order | High volatility moments |

| Limit Order | When targeting specific entry points |

| Stop-Loss Order | Protecting against downturns |

According to a report by Chainalysis 2025, utilizing the right order types can reduce trading losses by up to 30%.

Real-World Applications and Examples

Let’s break it down. Suppose you spot a potential surge in a coin’s value but are unsure of when to buy. A limit order allows you to set a buying price. If the market hits that price, your order executes, allowing you to buy at a favorable rate.

Conclusion: Elevate Your Trading Skills

In summary, mastering the HIBT order types can significantly improve your trading strategy. Whether you’re focusing on đặt hàng ngay lập tức or a nguyên tắc đặt hàng cụ thể, understanding how to navigate these options is critical as the crypto market evolves.

For tips and strategies specific to the Vietnam market, check our resources on local digital asset growth rates, which are among the highest in Asia.

Start employing these order types today and watch your trading efficiency soar. Download our trading checklist for more insights!

Stay ahead in the game with thedailyinvestors, your trusted resource for cryptocurrency trading!