Understanding HIBT P/E Ratio Valuation Metrics in Cryptocurrency

Introduction to HIBT and Its Relevance in Cryptocurrency

As cryptocurrency continues to gain traction globally—with over 560 million cryptocurrency holders—understanding valuation metrics like HIBT P/E ratio is crucial. But what exactly does this mean for potential investors?

What is HIBT P/E Ratio?

The HIBT P/E ratio (Price-to-Earnings ratio) serves as a comparative metric in assessing the valuation of cryptocurrencies, particularly tokenized assets. By analyzing this ratio, investors can gauge whether a cryptocurrency is overvalued or undervalued compared to its earnings. In the ever-evolving landscape of digital currency trading, this metric provides insight into a token’s performance relative to its price.

How to Utilize HIBT P/E Ratio in Your Investment Strategy

Investors can leverage the HIBT P/E ratio by:

- Comparing with industry averages: If HIBT’s ratio significantly deviates from its peers, it may indicate an opportunity.

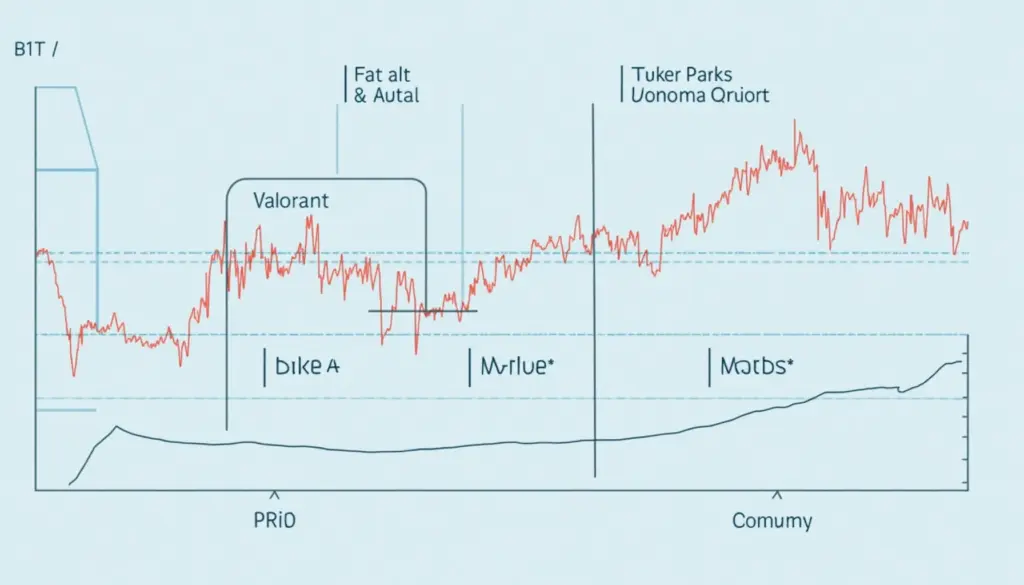

- Analyzing historical performance: Look at trends over time to assess future performance possibilities.

- Integrating with other metrics: Combine it with blockchain technology principles and market sentiment to obtain a holistic view of potential investments.

Long-tail Keywords: Future Potential and Safety Storage

For those asking “what are the most promising altcoins for 2025”, keep an eye on those with favorable HIBT P/E ratios. Additionally, as you navigate investments, consider exploring how to securely store your cryptocurrency, ensuring you’re protected against market volatility.

Regional Considerations in HIBT P/E Assessment

Specifically, if you’re operating in regions like Singapore, understanding local tax implications related to cryptocurrency transactions and P/E ratios can further refine your investment strategy.

Conclusion: Take Charge of Your Cryptocurrency Journey

The HIBT P/E ratio valuation metrics can provide investors with the insights needed to make informed decisions in the volatile world of cryptocurrency. As you embark on your investment journey, remember to combine this metric with thorough research and local regulations. Ready to dive deeper? Check out our resources and start making smarter investment choices today!

Disclaimer: This article does not constitute investment advice. Please consult local regulatory agencies before making decisions.