2025 Cross-Chain Payment Channels Explained

2025 Cross-Chain Payment Channels Explained

According to Chainalysis, a staggering 73% of cross-chain bridges globally have vulnerabilities. As cryptocurrency adoption grows, so does the need for secure and efficient HIBT payment channels.

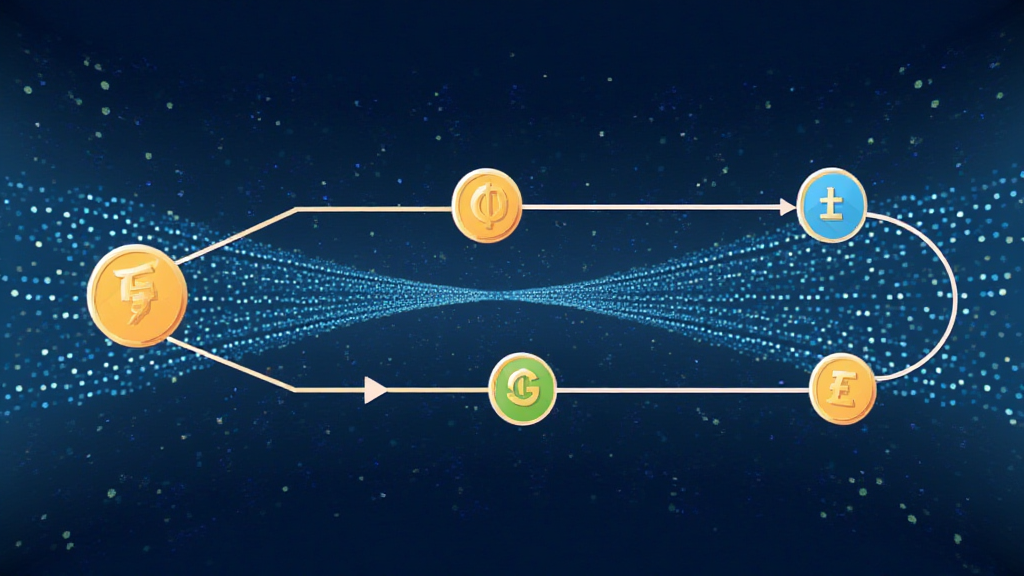

Understanding HIBT Payment Channels

Imagine a bustling market where vendors trade goods. Just as they need a reliable way to exchange cash for produce, cryptocurrency users require secure channels to convert and transfer coins across blockchains. HIBT payment channels serve as these transactional hubs, facilitating smooth cross-chain interactions.

Why Cross-Chain Interoperability Matters

In 2025, experts predict that cross-chain interoperability will be vital for DeFi’s growth. As various decentralized platforms emerge, integrating different blockchain networks will enable seamless user experiences. Without such interoperability, blockchain silos limit innovation. For instance, if you’ve ever had a tough time exchanging your local currency for a rare item, you can appreciate the ease that HIBT payment channels bring to cryptocurrency trading.

The Role of Zero-Knowledge Proofs

Zero-knowledge proofs (ZKPs) might sound technical, but they work like a secret code between friends. When using HIBT payment channels, ZKPs ensure that transactions can be validated without revealing sensitive information. This technology not only secures your assets but also promotes privacy in every transaction.

Looking Ahead: The Future of Payment Channels

As we approach 2025, understanding the evolution of payment channels is crucial. With regulatory trends in places like Singapore pushing for clearer DeFi guidance, adopting HIBT payment channels will be pivotal. Are you ready to navigate this dynamic landscape?

In conclusion, HIBT payment channels are essential in bridging the gaps between different blockchains. To stay informed, download our toolkit designed to help you navigate these innovations effectively.

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory authorities before making any financial decisions (e.g., MAS, SEC).