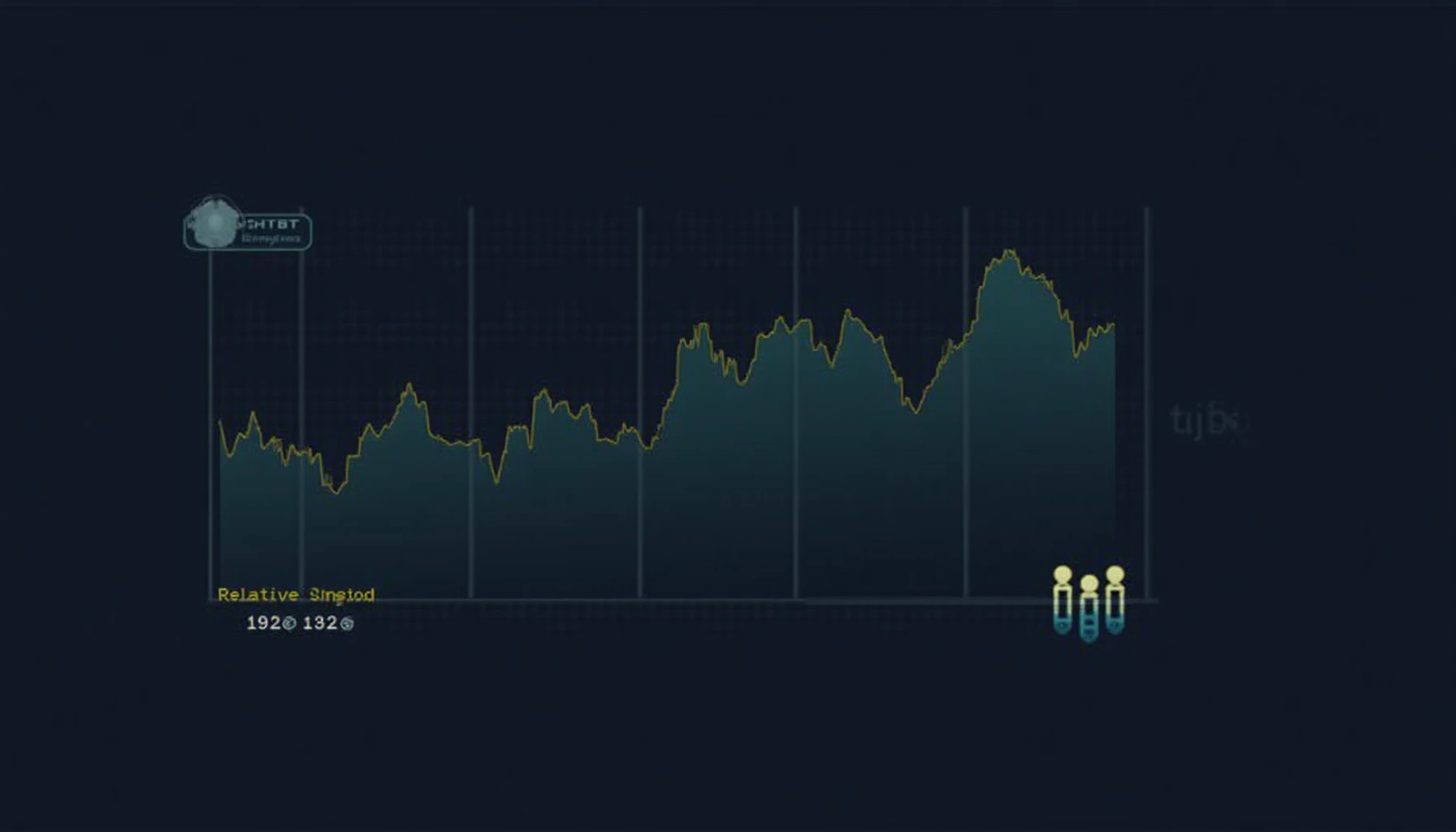

Understanding the HIBT Relative Strength Index in Cryptocurrency Trading

Is Your Crypto Trading Strategy Working?

Are you among the millions of cryptocurrency traders looking for effective strategies? With over 5 million traders facing the uncertainty of volatile markets, understanding technical indicators becomes crucial. The HIBT relative strength index (RSI) is one such tool that can significantly enhance your trading decisions.

What is the HIBT Relative Strength Index?

The HIBT relative strength index is a momentum oscillator that measures the speed and change of price movements. It helps traders determine overbought or oversold conditions in a market, which can guide investment decisions. But how does it relate to digital asset trading?

- High RSI Value: An RSI above 70 might indicate that a cryptocurrency is overbought.

- Low RSI Value: An RSI below 30 signals that it might be oversold.

Understanding these levels can provide insights into market corrections. For instance, many traders will consider purchasing a coin after it shows an RSI below 30.

How to Utilize HIBT RSI in Your Strategy

Incorporating the HIBT RSI into your digital currency trading strategy can be straightforward:

- Set time frames: Choose a specific period for RSI analysis, often using the 14-day timeframe.

- Identify trends: Use the RSI to capture the momentum of price movements.

- Combine with other tools: Pair with moving averages or volume indicators for comprehensive market analysis.

For example, if Bitcoin demonstrates an RSI below 30 while its moving average shows a bullish pattern, it might be reasonable to consider buying.

Common Misunderstandings About RSI

Many newcomers may overlook some facts when using the HIBT RSI:

- RSI is not infallible: It merely indicates potential trends based on historical data, not guaranteed future performance.

- Lagging indicator: Like other technical indicators, its results are based on past price movements, so you should not rely solely on it.

Final Thoughts: Enhancing Your Trading Portfolio

By understanding how to utilize the HIBT relative strength index, traders can make more informed choices in the dynamic crypto marketplace. Remember, effective trading combines knowledge and strategy: don’t just rely on indicators, but combine them with thorough market research and risk management strategies. If you want to dive deeper, check out our comprehensive resources on cryptocurrency trading strategies at hibt.com!

Stay ahead of the game with tools like the Ledger Nano X, which can significantly reduce your hacking risks. Always be informed and cautious!