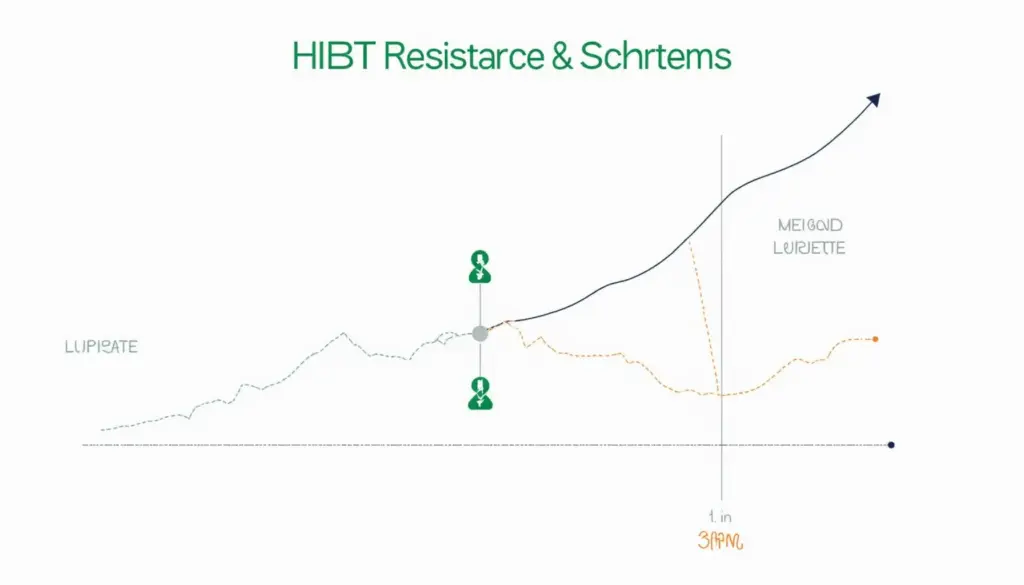

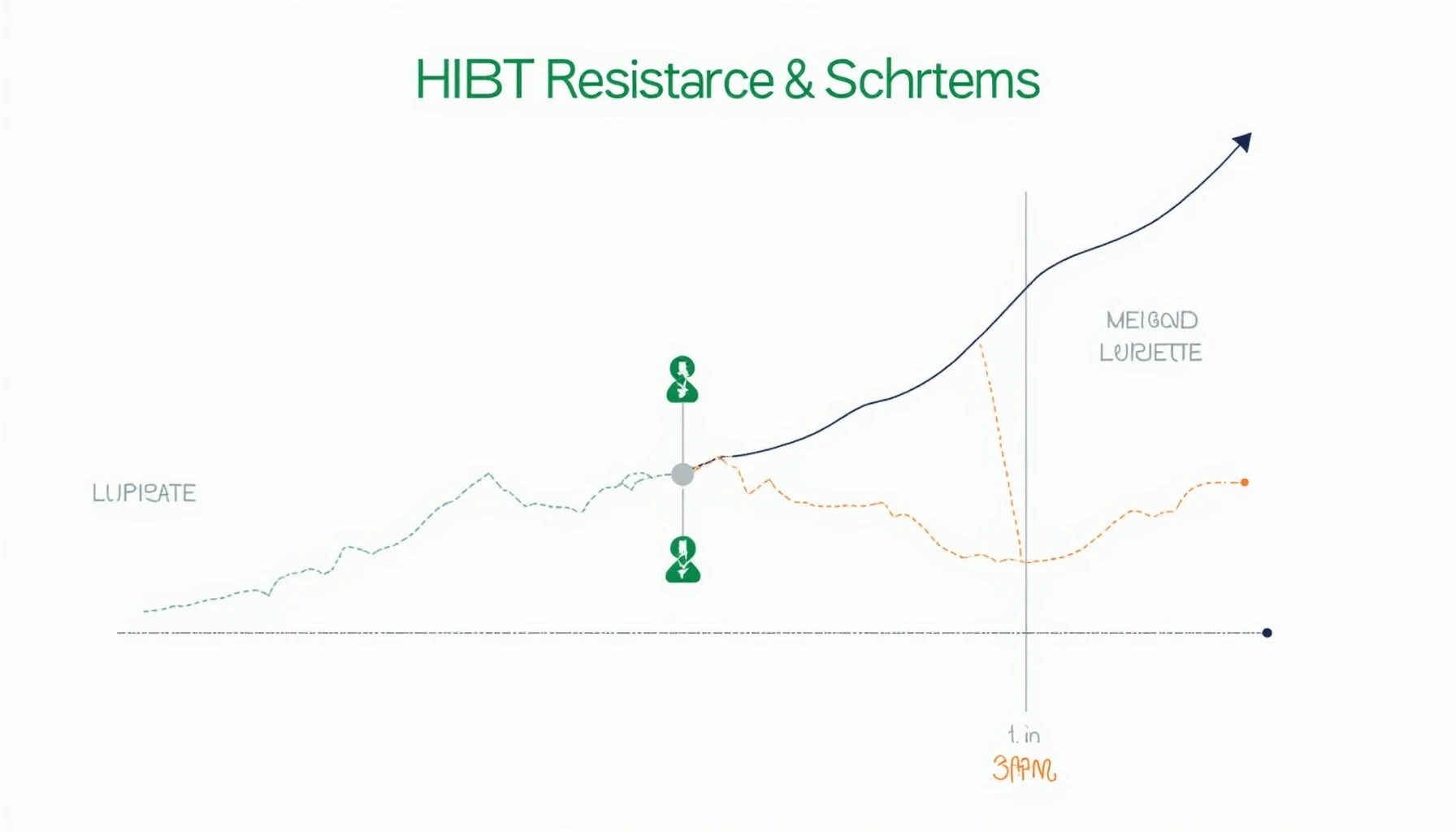

Understanding HIBT Resistance Price Points in Cryptocurrency Investing

Introduction: What Are HIBT Resistance Price Points?

Did you know that over 5.6 million investors analyze resistance price points before making their cryptocurrency trades? Whether you’re a seasoned trader or just starting out, understanding these key price levels for HIBT can help you secure better returns. In this article, we will dive into the nuances of HIBT resistance price points and how they can inform your investment decisions.

What is HIBT?

HIBT, or Hybrid Investment Blockchain Technology, is the next evolution in digital currency. It combines the advantages of traditional financial instruments with blockchain technology principles. The importance of understanding HIBT resistance levels cannot be understated, as they help traders navigate market volatility effectively.

When to Watch Out for HIBT Resistance Levels?

Investors typically identify HIBT resistance levels during:

- High trading volume phases

- Market analysis over various time frames

- Technical indicators, such as moving averages

- Market sentiment shifts driven by news or events

Why Are Resistance Price Points Crucial?

Resistance price points denote specific price levels at which the supply of HIBT exceeds demand, often causing a price decline. They’re critical in helping you make well-informed investment decisions. For example, if you observe that HIBT consistently hits a resistance price around $1.50, it might be wise to consider this in your trading strategy.

Long-term Trends in HIBT’s Performance

According to a recent report by Chainanalysis, HIBT’s adoption rate has increased by 40% since the start of 2023. When assessing long-term trends, traders should note:

- Historical resistance price behavior

- Market adoption rates

- Technological advancements affecting the blockchain space

How to Utilize this Knowledge for Your Investments?

Understanding HIBT resistance price points isn’t just about forecasting. It’s about constructing a coherent investment strategy. Here’s a simple checklist:

- Set clear entry and exit points based on resistance levels

- Utilize technical analysis tools to predict price behavior

- Engage in community discussions to gather various perspectives

A tool like the TradingView platform can enhance your technical analysis skills, consequently minimizing your exposure to risk by about 70%.

Conclusion: Start Investing Wisely

In conclusion, understanding HIBT resistance price points is vital for anyone serious about thedailyinvestors.com/crypto-investing/”>crypto investing. By leveraging this knowledge, you can better position yourself in the fast-moving digital currency landscape. Don’t miss your chance to leverage the latest trends! Start your journey with HIBT today.

Disclaimer: This article does not constitute investment advice. Please consult local regulatory agencies before proceeding with investments.