HIBT Retail vs Institutional Trading: What You Need to Know

Introduction

With the ever-growing interest in cryptocurrencies, understanding the nature of trading has become essential. Did you know that in 2023, retail traders accounted for approximately 75% of all crypto transactions? As such, knowing the differences between HIBT retail vs institutional trading can significantly impact your investment strategy.

The Basics of HIBT Trading

Before diving deeper, it’s crucial to comprehend what HIBT entails. HIBT stands for Hybrid Inter-Broker Trading, blending elements from both retail and institutional trading realms. Retail trading often involves individual investors, while institutional trading typically involves large entities such as hedge funds and investment firms. Understanding these distinctions can help you navigate the market effectively.

Retail Trading: Pros and Cons

- Accessibility: Retail traders benefit from easier access to trading platforms.

- Lower Capital Requirement: They require less initial capital to start trading.

- Market Influence: Retail movements can drive market trends.

- Volatility Risk: The retail market is often more volatile due to emotional trading.

Institutional Trading: Pros and Cons

- Higher Liquidity: Institutional trading generally leads to improved liquidity.

- Advanced Strategies: Institutions employ sophisticated trading algorithms and strategies.

- Market Stability: They provide more stability to the market.

- High Capital Requirement: Requires significant investments, which may not be accessible to all investors.

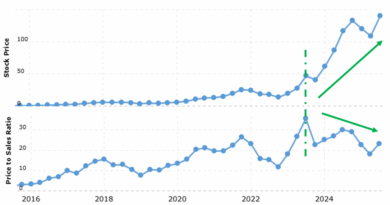

Market Trends in Vietnam

In Vietnam, the crypto market is burgeoning, with an estimated growth rate of 250% in crypto users over the past year. This rising interest emphasizes the importance of understanding the HIBT retail vs institutional trading dynamics, especially given the keen participation of retail investors.

Choosing Your Path: Retail vs Institutional

When deciding between retail and institutional trading, consider your investment goals, risk tolerance, and available resources. For those who prefer high risk with potential high reward, retail trading might be ideal. Conversely, if you’re looking for stability and strategic guidance, institutional trading could be the better choice. Here’s a catch: retail trading can sometimes offer more agile flexibility in rapidly changing market conditions.

Conclusion

In conclusion, understanding the intricacies of HIBT retail vs institutional trading is vital for seizing market opportunities and making informed investment choices. Whether you resonate more with retail strategies or seek the backing of institutional players, knowledge is your best ally. As the Vietnamese crypto landscape continues to evolve, leveraging these insights can significantly enhance your trading experience.

For more information on trading strategies, visit HIBT and download our comprehensive trading checklist.

Author: Dr. Minh Tran, a blockchain consultant with over 15 publications in crypto economics and a lead audit specialist for known projects like CryptoX and CoinSafe.