Understanding HIBT RSI Overbought Signals

Introduction to HIBT RSI Overbought Signals

In 2023, $5.2 billion was lost in crypto scams alone, highlighting the urgent need for informed trading strategies. This is where HIBT RSI overbought signals come into play. These signals are essential for identifying potential market reversals, providing invaluable insights for crypto investors.

The Basics of HIBT RSI

The HIBT (High-Interest Blockchain Tokens) RSI (Relative Strength Index) measures the momentum of a cryptocurrency’s price. A reading above 70 typically indicates that an asset may be overbought. Understanding these signals assists investors in making timely decisions.

How to Spot Overbought Signals

Like a beacon guiding ships, HIBT RSI overbought signals highlight when an asset’s price might be peaking. Here are steps to identify these signals:

- Monitor RSI values—above 70 signals overbought conditions.

- Combine with volume analysis—high trading volume may further confirm the signal.

- Look for divergence—if prices keep rising but the RSI starts to fall, a reversal is likely.

Case Study: Vietnam’s Crypto Market

In Vietnam, the crypto user growth rate is projected to reach 35% in 2025. Investors in this burgeoning market must be equipped with tools to decode HIBT RSI signals, as local projects become prominent.

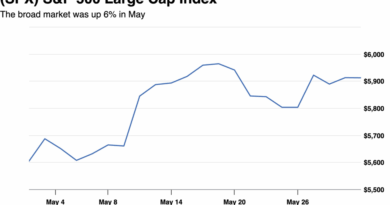

Real-Time Data and Current Trends

According to Chainalysis, crypto investment trends have shown that 68% of Vietnamese users rely on technical indicators like RSI. As more investors adopt these signals, competition intensifies, making understanding HIBT RSI crucial.

Conclusion: Enhancing Crypto Strategies with HIBT RSI

Ultimately, integrating HIBT RSI overbought signals into your trading strategy can help navigate market volatility effectively. Keep informed and utilize robust data backing your decisions download our comprehensive guide today.