HIBT RSI Oversold Reversal Signals: Spotting Opportunities in Cryptocurrency Trading

Introduction: Are You Missing Out on Market Reversals?

With over 560 million cryptocurrency holders worldwide, do you think you’re accurately spotting oversold reversal signals? In the cryptocurrency trading space, utilizing tools like the HIBT RSI can provide critical insights. Understanding these signals could lead to lucrative opportunities in the vibrant world of digital currency trading.

What Are HIBT RSI Oversold Reversal Signals?

To grasp the importance of HIBT RSI oversold reversal signals, let’s break it down in simpler terms. Imagine you’re at a crowded farmer’s market, and the prices of fresh apples suddenly drop. If you know apples have a history of bouncing back in price, you might seize the chance to buy at a low cost. In the same way, these signals suggest that a particular crypto asset might be undervalued and due for a rebound.

Why Is Understanding RSI Crucial in Cryptocurrency Trading?

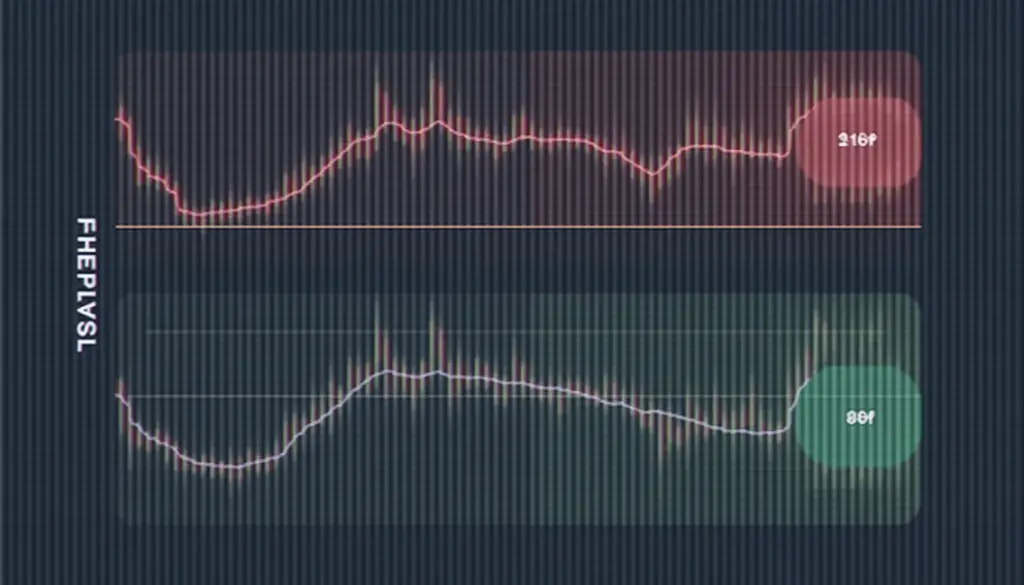

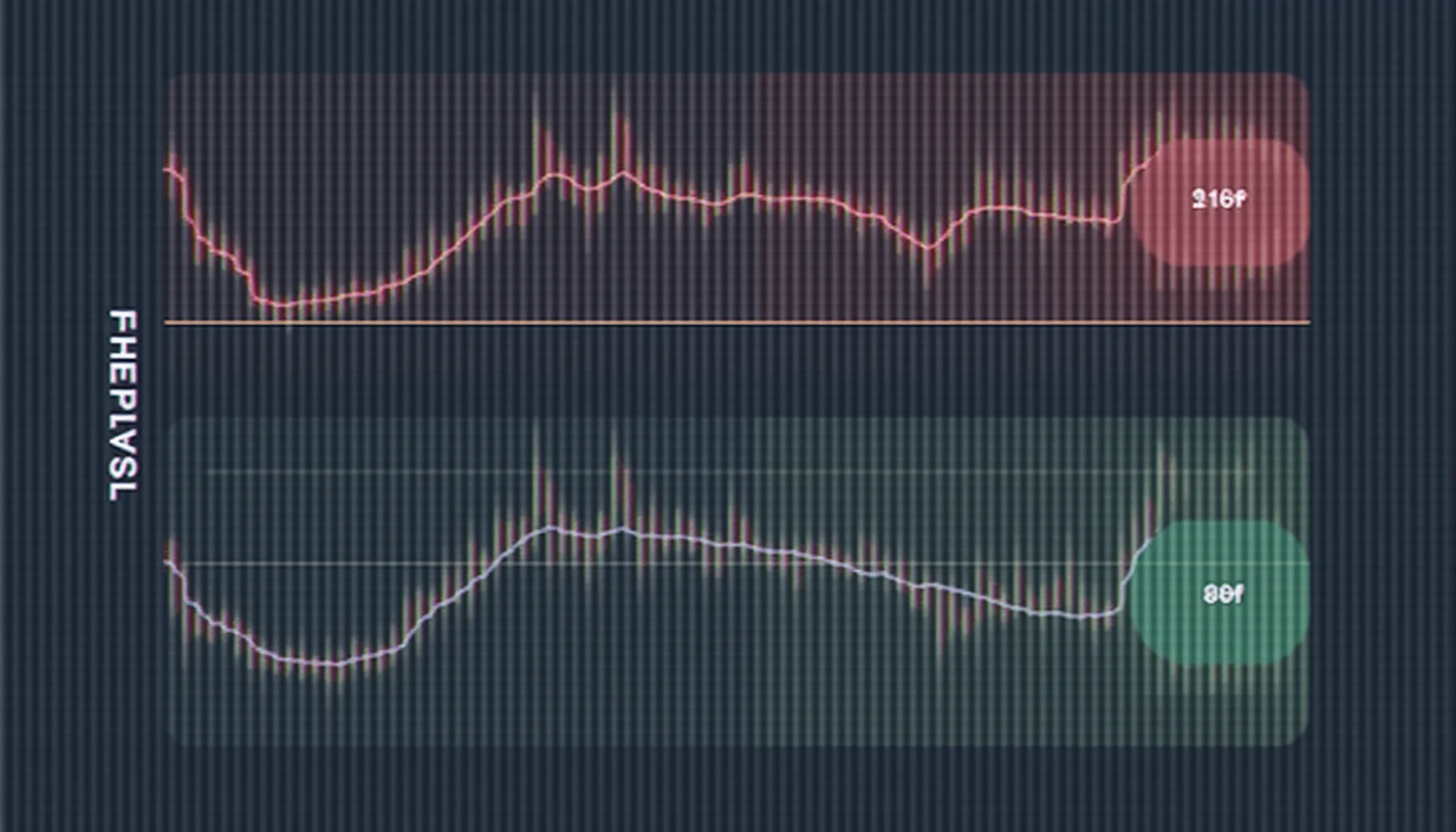

The Relative Strength Index (RSI) is a popular technical analysis tool used by traders to assess whether an asset is overbought or oversold.

Here’s a quick breakdown of its benefits:

- Identifies Market Trends: Helps predict price movements based on historical data.

- Improves Decision-Making: Guides traders to enter or exit positions effectively.

- Enhances Risk Management: Offers insights that can help protect investments.

How to Spot HIBT RSI Oversold Reversal Signals?

To effectively recognize these signals, a few steps can aid newcomers and seasoned traders alike:

- Understand the RSI Range: RSI values below 30 typically indicate that an asset is oversold.

- Check Other Indicators: Combine RSI with other tools like MACD or support levels for better accuracy.

- Monitor News and Events: Crypto prices can be influenced by external factors; stay informed!

Real-Life Application: Using HIBT RSI in Your Trading Strategy

Imagine you’re considering investing in a cryptocurrency that has recently seen a drastic price drop due to market correction. Instead of guessing when to buy, you could apply the HIBT RSI signals. If it shows oversold conditions, and you’ve done your research, it might be the perfect opportunity. For instance, as reported in the 2023 Chainanalysis Report, prices in the Asia-Pacific region surged by 40% after similar signals appeared!

Conclusion: Take Advantage of HIBT RSI Signals Now!

Understanding HIBT RSI oversold reversal signals can place you ahead of the curve in cryptocurrency trading. With a bit of research and attention to these indicators, your trading strategy can become much more effective. Don’t wait—start monitoring these signals and position yourself for potential gains in a volatile market. Remember, making informed decisions is key in the realm of cryptocurrency.

For more insights and tools to enhance your trading experience, visit HIBT. By doing so, you’ll gain valuable knowledge to help you navigate the complex world of digital currency.