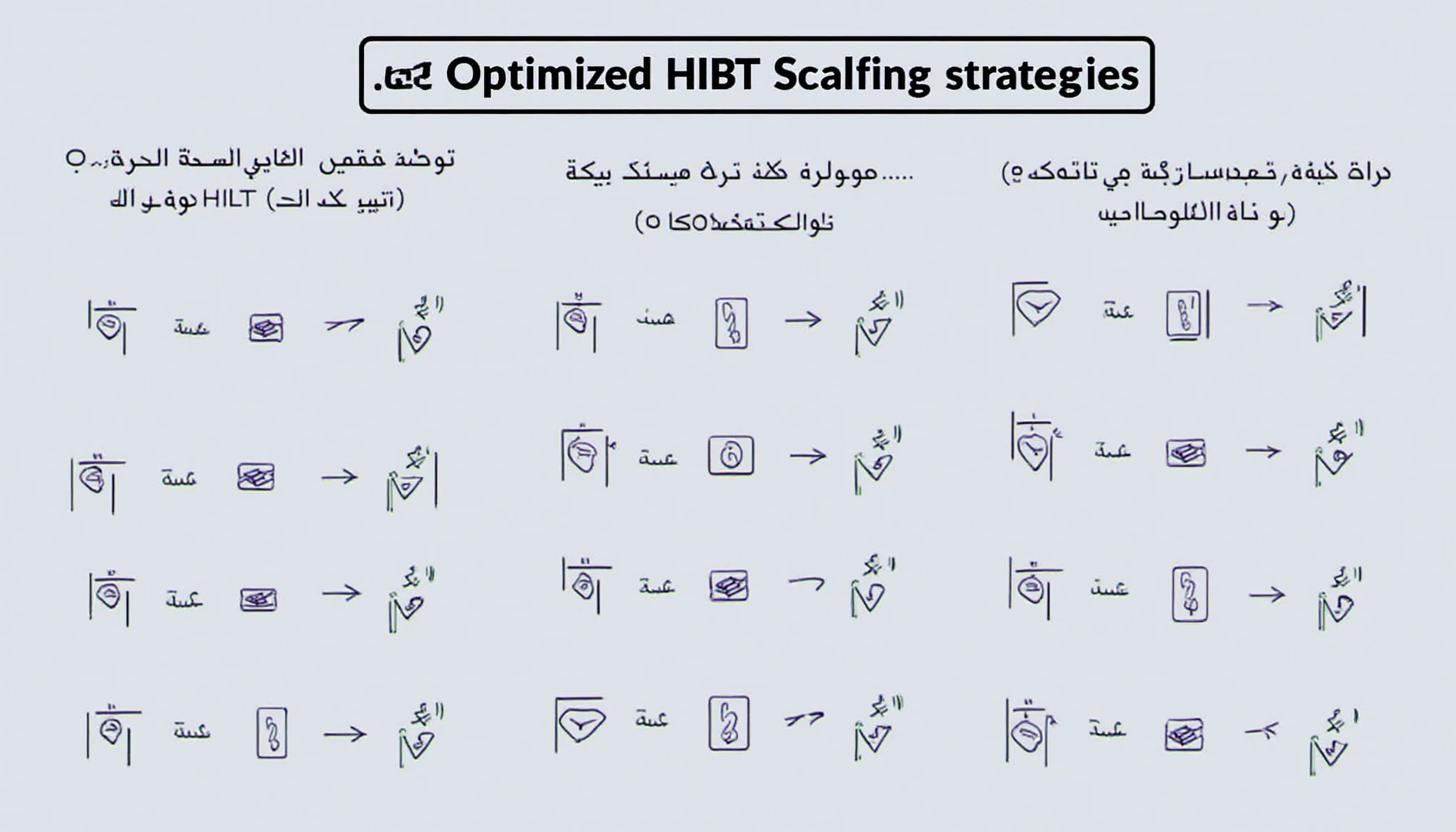

HIBT Scalping Strategies Optimized

HIBT Scalping Strategies Optimized

With the crypto market experiencing a significant growth, especially in Vietnam where the number of users has increased by over 20% year-on-year, effective trading strategies have become essential. HIBT, or High-frequency Institutional-based Trading, offers a unique approach to maximizing returns in such a volatile environment.

Understanding HIBT Scalping

Scalping in the HIBT context means making quick trades that capitalize on small price movements. Think of it like a bank vault that secures your assets while you make rapid transactions. For instance, by purchasing a cryptocurrency at $50 and selling it at $51, the profit margins may seem small, but they add up over time!

Key Components of Effective Scalping

- Market Analytics: Always stay updated with real-time data. Analyzing charts effectively increases the chance of success.

- Risk Management: Diversifying trades and setting stop-loss orders protect against sudden market volatility.

- Timing: Identify prime trading hours when market movements are significant, such as during major news releases.

Leveraging Technology

Utilizing trading bots can increase the effectiveness of your scalping strategy. These tools operate 24/7 and execute trades based on pre-set parameters. Remember, effective HIBT strategies also rely on the security of your trading platform. As of 2025, download our security checklist to ensure that your assets are threat-free!

Vietnam’s Growing Market

As crypto adoption soars in Vietnam, with a market growth rate of 25% expected in 2025, strategic investing becomes even more vital. Implementing HIBT scalping strategies can yield better returns in this booming market. Remember, showing keen awareness of market trends can significantly impact your success rate.

Conclusion

Optimizing your approach to HIBT scalping strategies can lead to a more fruitful trading experience. Taking careful, calculated steps may help you navigate the complex world of cryptocurrency with more confidence. Always adapt to new market conditions and remain vigilant of potential risks. After all, being proactive ensures your investments are secure and growing.

For further insights and resources, visit thedailyinvestors.