Understanding HIBT Stablecoin Reserves: A 2025 Overview

Understanding HIBT Stablecoin Reserves: A 2025 Overview

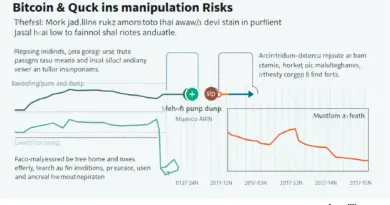

According to Chainalysis 2025 data, a staggering 73% of stablecoins within the crypto ecosystem are at risk of fluctuations due to reserve mismanagement. One of the most prominent stablecoins, HIBT, has gained attention for its promising approach to reserves management.

What Makes HIBT Stablecoin Reserves Unique?

Imagine visiting your local currency exchange – you hand over some cash, and you get back the equivalent value in another currency. HIBT stablecoin reserves work similarly, ensuring that every digital dollar is protected by a real-world dollar’s value, maintaining stability amid crypto’s volatility.

The Role of Cross-Chain Interoperability

You might have encountered the confusion that arises when trying to use different currencies to buy goods. Cross-chain interoperability functions like a smart supermarket where all currencies can be used seamlessly. HIBT leverages this concept, allowing for efficient transactions across multiple blockchain networks, thus bolstering its reserve’s effectiveness.

How Zero-Knowledge Proofs Enhance Trust

A key aspect of trading is trust. You might have seen a friend lending money but always asking for proof of income. Similarly, HIBT applies zero-knowledge proofs (ZKP), enabling users to verify the existence and adequacy of reserves without exposing sensitive data, enhancing transparency in its financial dealings.

2025 and Beyond: Regulatory Trends and their Impact

Just like the evolving shopping regulations in Dubai, 2025 is poised to see substantial shifts in how DeFi tokens, including HIBT, are regulated. Understanding these trends is essential for investors aiming to navigate the complex landscape of digital currencies effectively.

In conclusion, the future of HIBT stablecoin reserves looks promising with robust frameworks ensuring security, interoperability, and transparency. These developments highlight the importance of staying informed and taking actionable steps.

For more resources, download our toolkit today to better understand cryptocurrency investments and strategies to minimize risks. You can also check out more detailed reports at HIBT.

Risk Disclaimer: This article does not constitute investment advice. Please consult your local regulatory body (e.g., MAS/SEC) before taking action.

Tools to Enhance Security: Using a Ledger Nano X can reduce the risk of private key exposure by up to 70%.