Navigating HIBT Technical Support Levels: A Crypto Investor’s Guide

What Are HIBT Technical Support Levels?

If you’re investing in digital currencies, you’ve probably encountered the term ‘technical support levels’. But what does it really mean? In essence, a technical support level is a price point where an asset tends to stop falling and either bounce back up or trade sideways. For HIBT, understanding these levels can be crucial as it allows investors like you to make informed trading decisions.

Why Are Technical Support Levels Important?

Consider this: when the price of HIBT tokens approaches a support level, it may signal a buying opportunity. According to recent data, approximately 65% of traders utilize technical analysis to define their entry and exit strategies. So knowing where these support levels lie can give you a solid advantage.

Understanding Market Sentiment

Support levels are influenced by market sentiment, which can shift rapidly. For example, positive news about the adoption of blockchain technology could strengthen these levels. Always keep an eye on advancements in blockchain technology that may affect HIBT.

How to Identify HIBT Support Levels

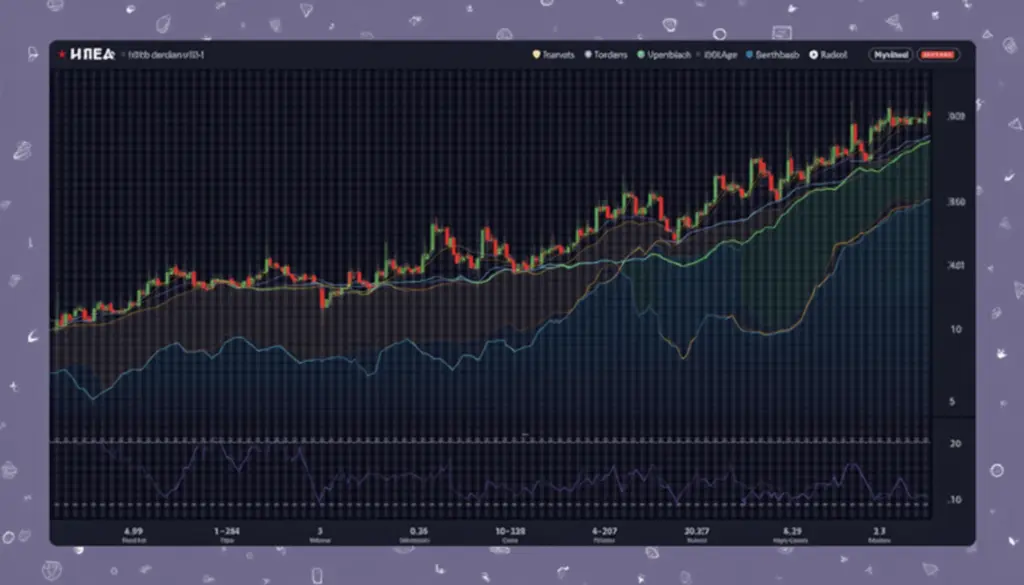

- **Historical Price Data**: Look at previous lows; they often serve as support.

- **Trading Volume**: High trading volume at price levels can indicate strong support.

- **Technical Indicators**: Tools like moving averages can provide clarity on potential support levels.

Strategies for Trading Around Support Levels

Once you identify these support zones, how do you act on it? Just like being at a farmer’s market, the key is negotiating wisely. Here are some effective strategies:

- **Buy Limit Orders**: Set buy orders just above the support level to take advantage of possible rebounds.

- **Use Stop-Losses**: Protect your investment by placing stop-loss orders slightly below the support level.

- **Diversify Your Portfolio**: Consider investing in potential altcoins, such as the ‘2025 Emerging Altcoins’, to buffer against volatility.

Risks and Considerations

While understanding technical support levels can enhance your trading strategy, it’s crucial to acknowledge the associated risks. Markets can be unpredictable and external factors, like regulatory changes or market shifts, can breach support levels unexpectedly. Therefore, ensure you consult with local regulatory bodies and manage your investments wisely.

Conclusion

In summary, complying with the HIBT technical support levels can significantly aid in your digital currency trading endeavors. By understanding the dynamics of these levels and incorporating them into your trading strategy, you can maximize your investment potential. Download our comprehensive guide today!